Breathtaking Info About Deferred Revenue Schedule Excel Template

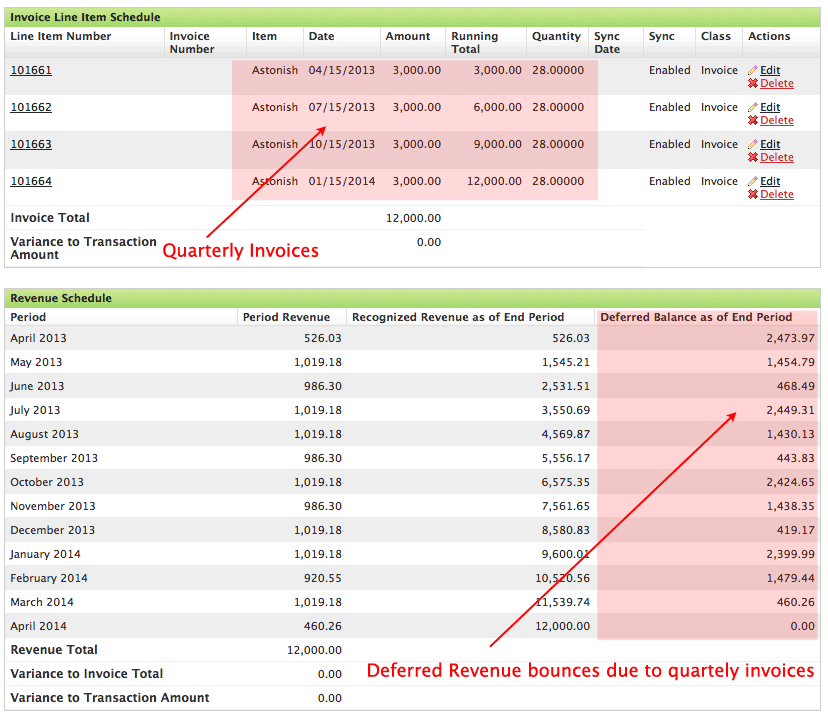

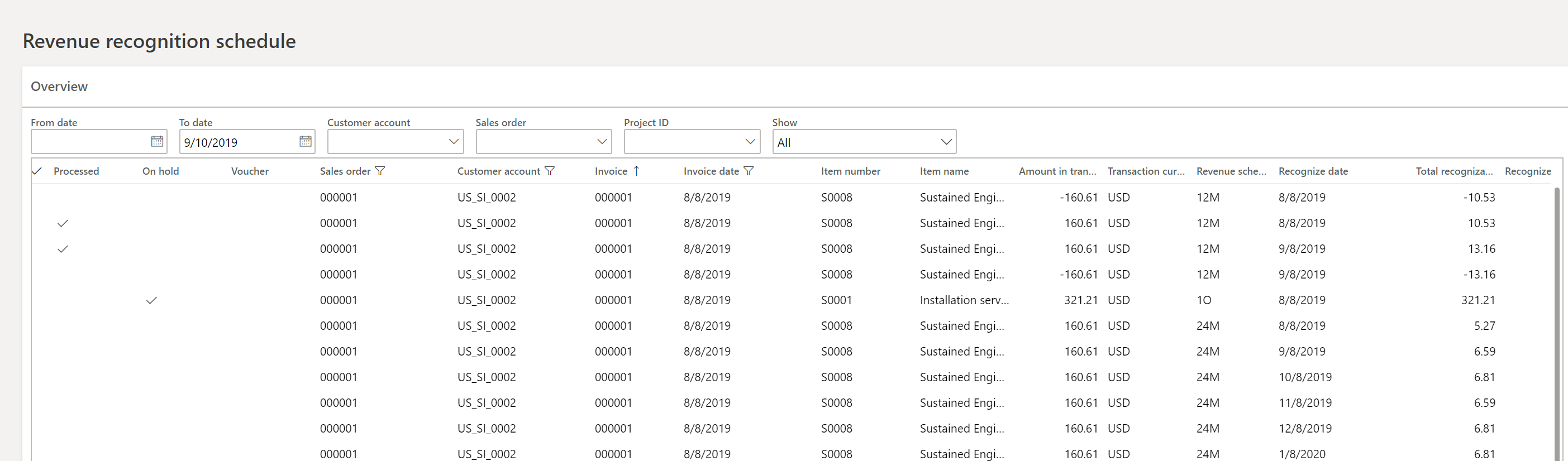

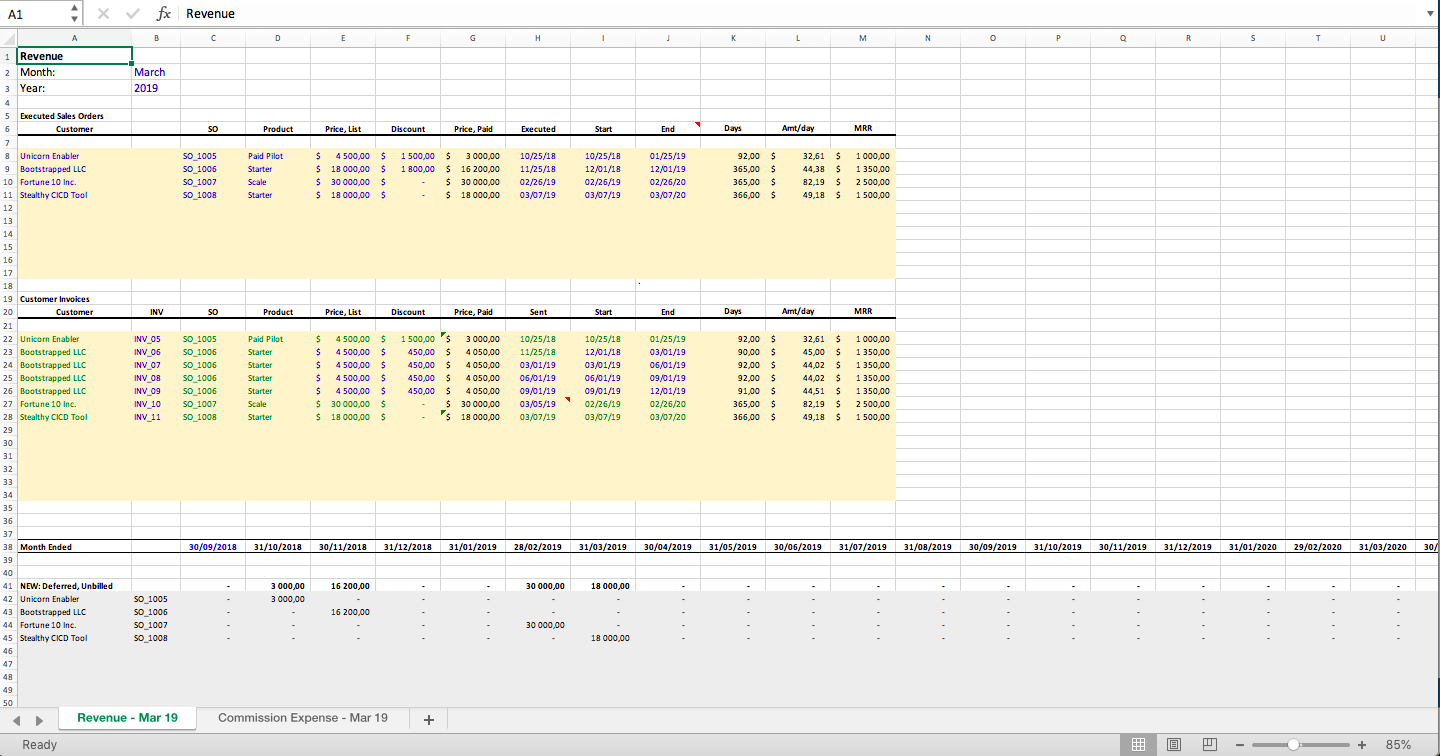

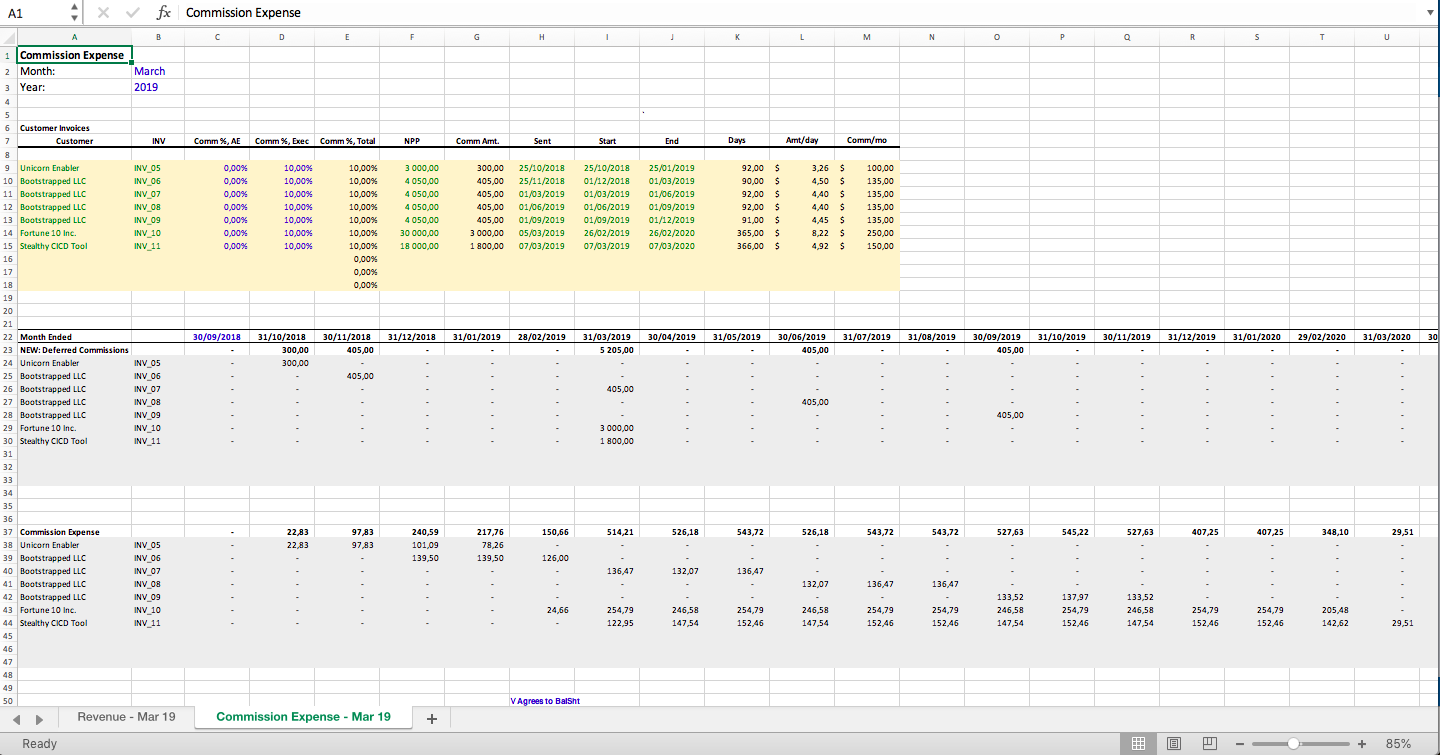

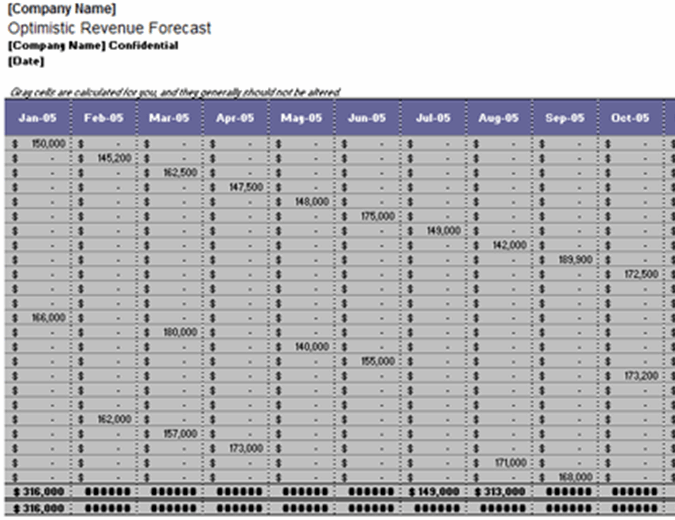

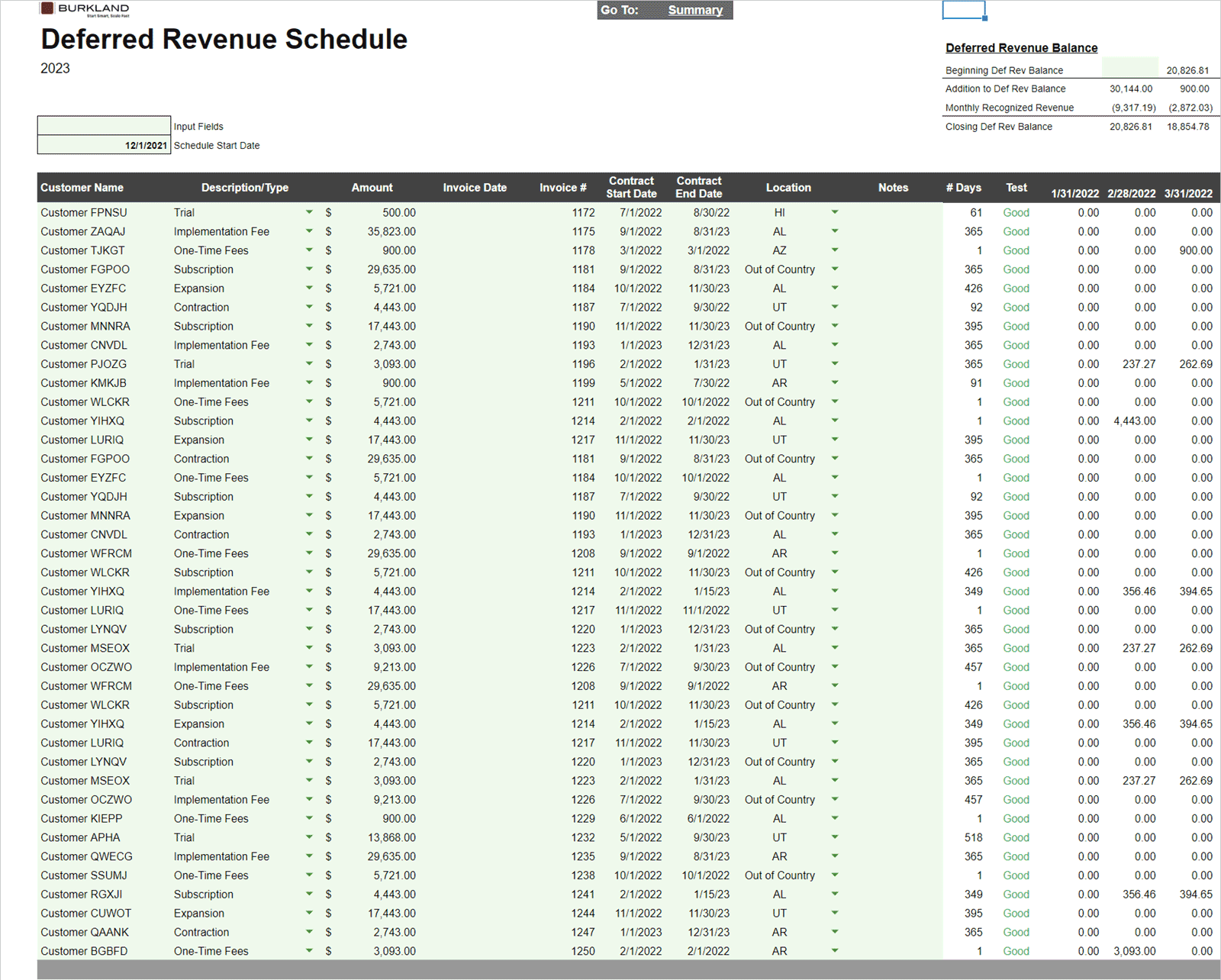

Sales from each month earn out equally over the course of twelve months.

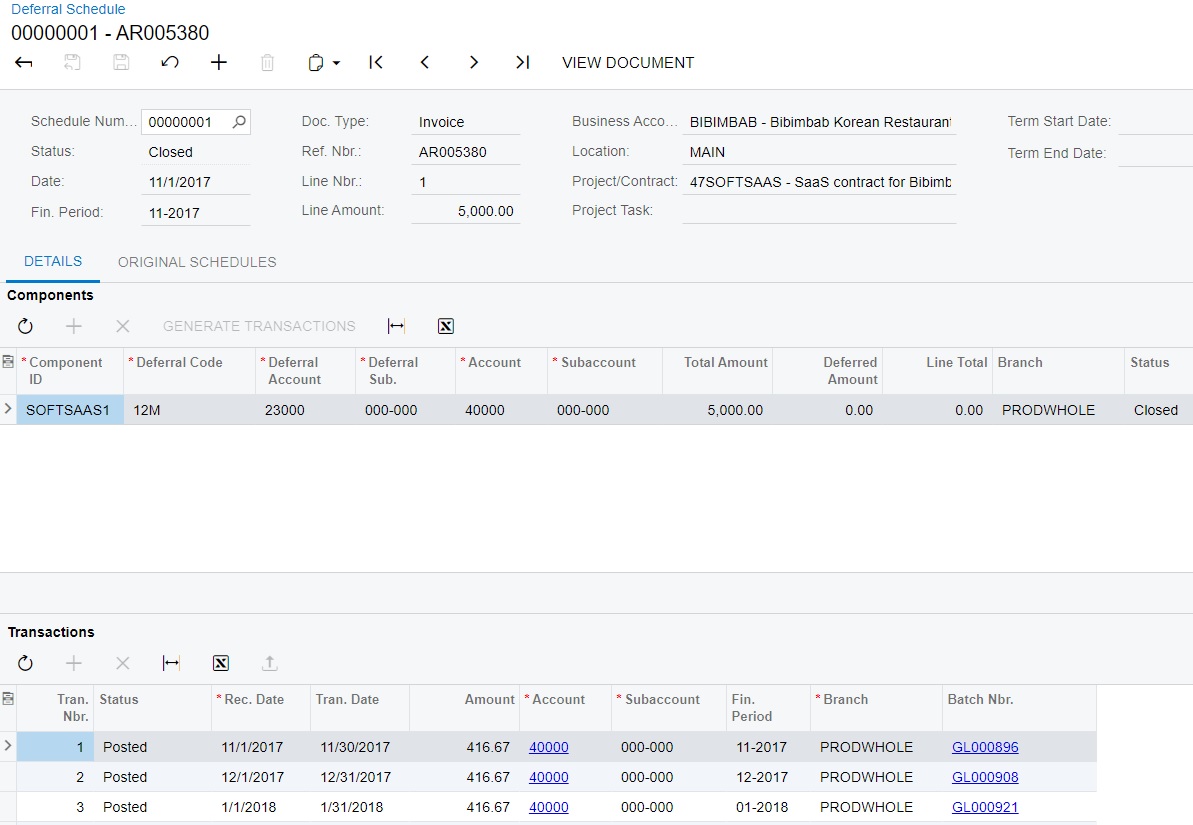

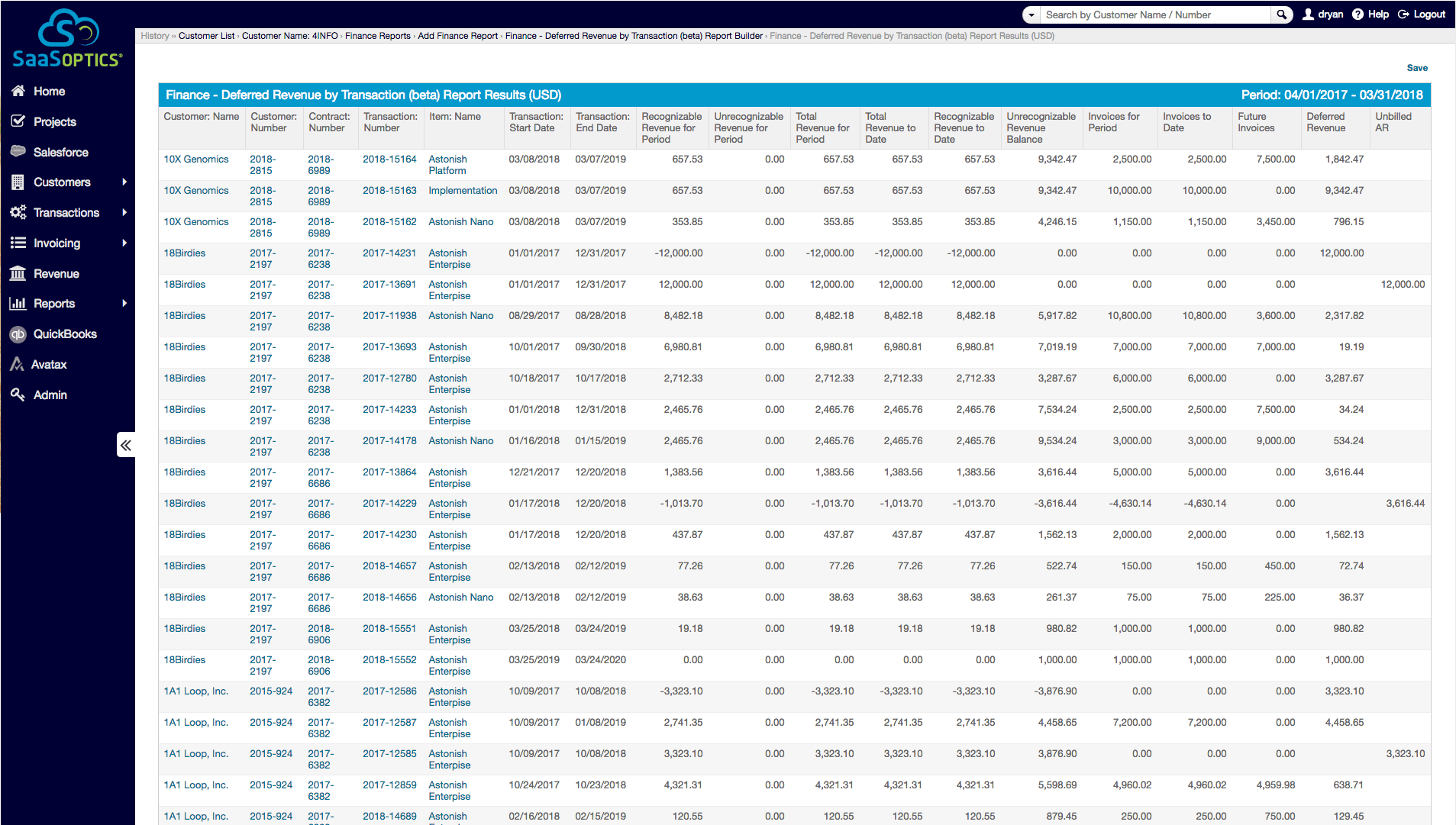

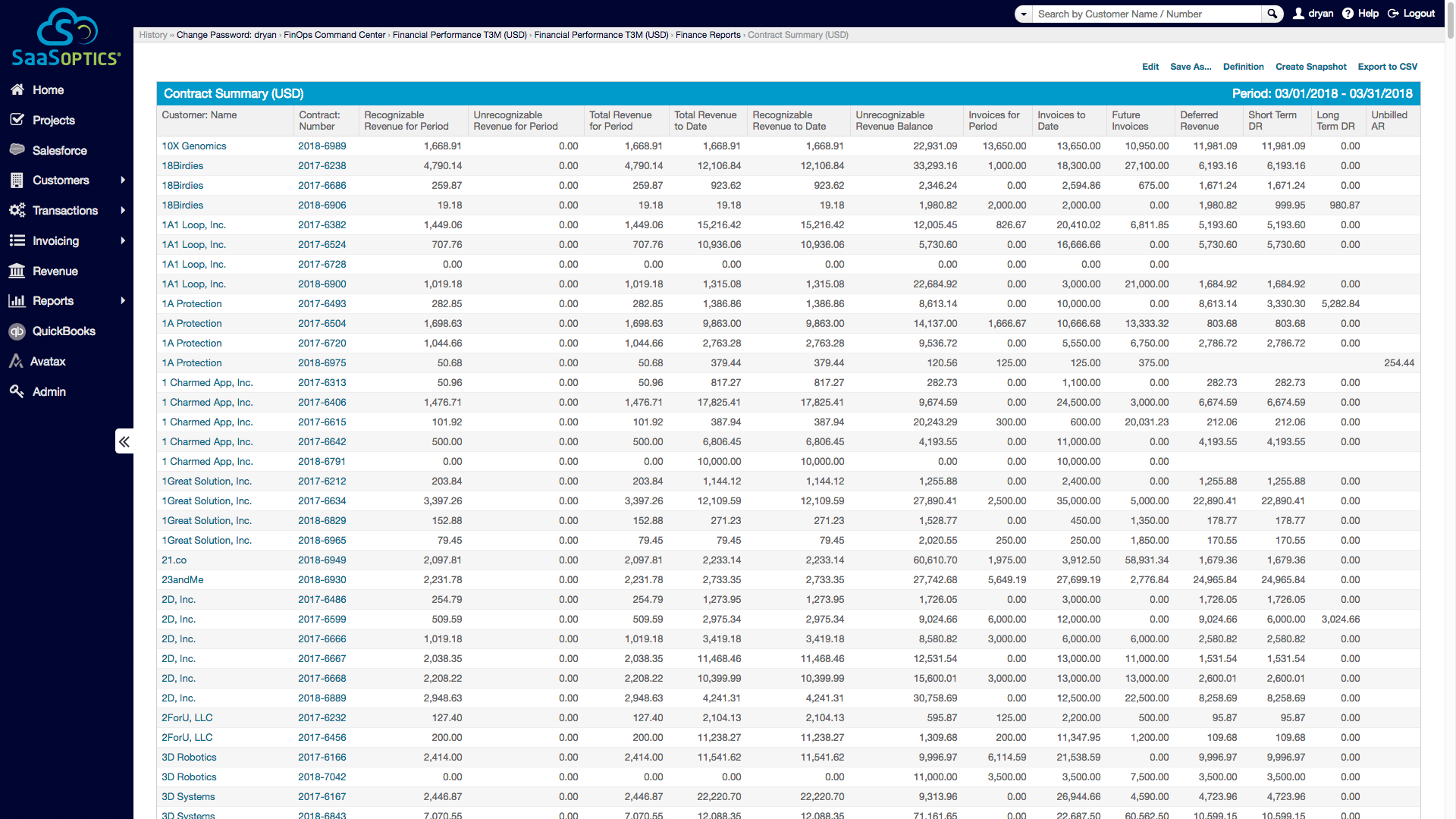

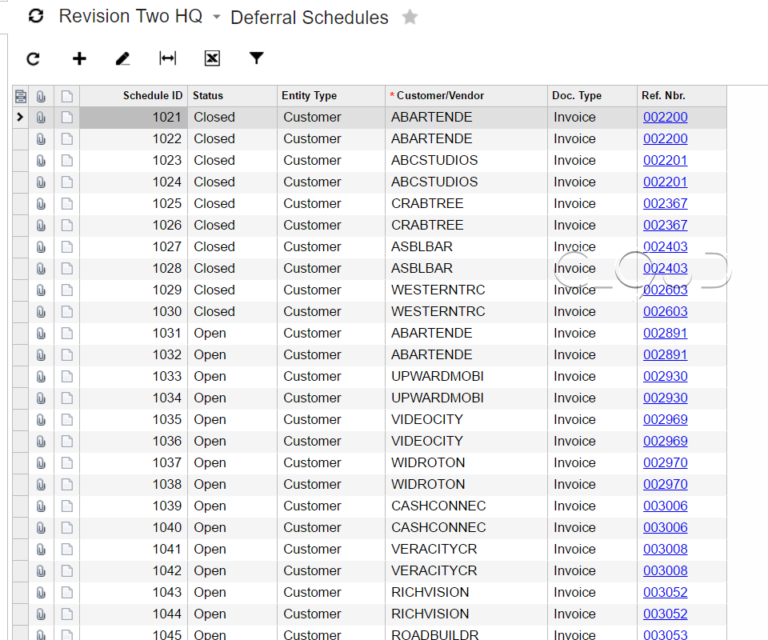

Deferred revenue schedule excel template. Common examples of deferred revenue include rent payments received in advance, annual subscription payments received at the start of the year, and an unused gift card. Properly recording these items can be challenging, but using excel can make the process much simpler. If you currently handle deferred revenue and saas revenue recognition on spreadsheets or need to kick off the process, please try this excel template and let me know how it works for you.

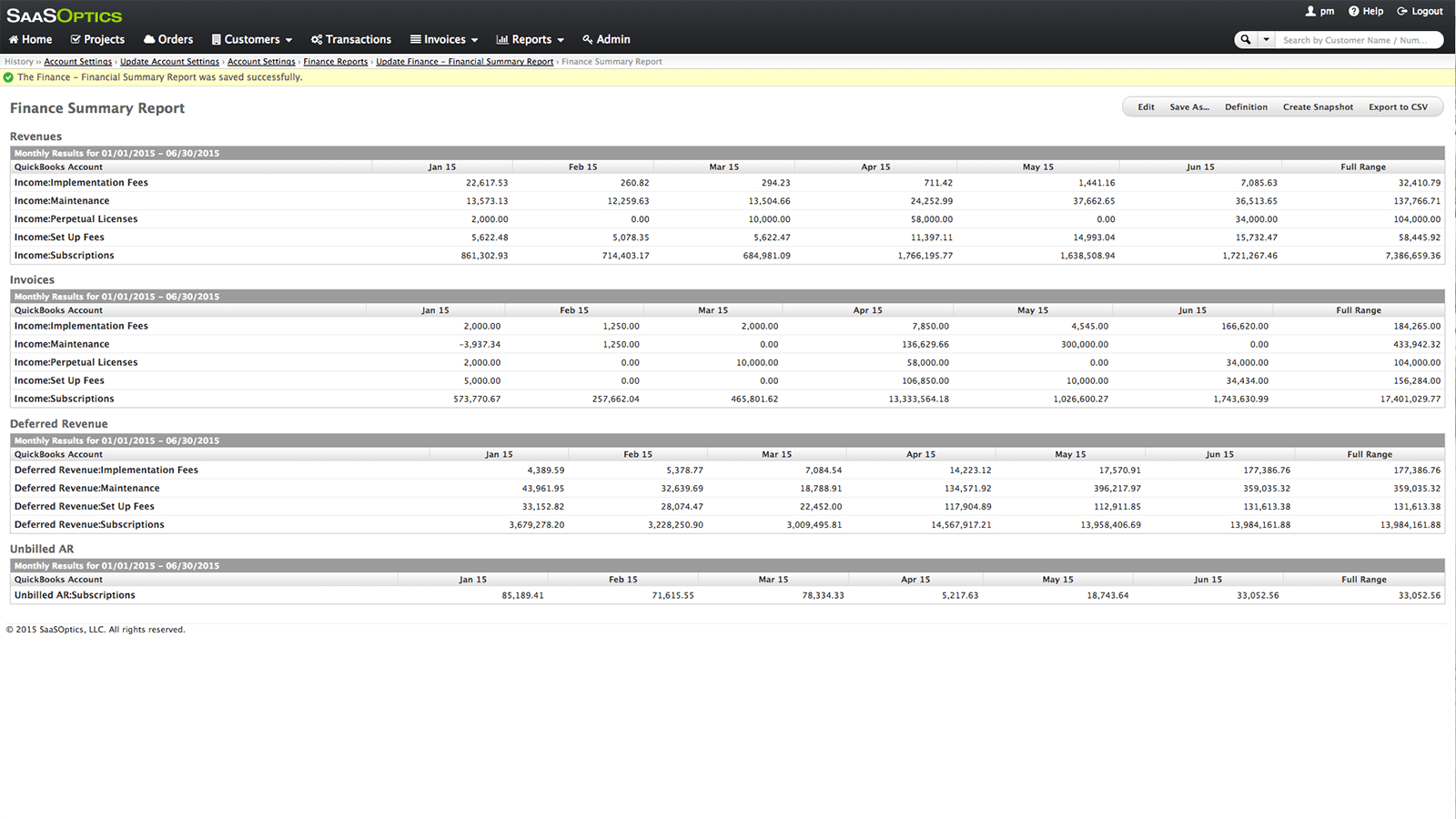

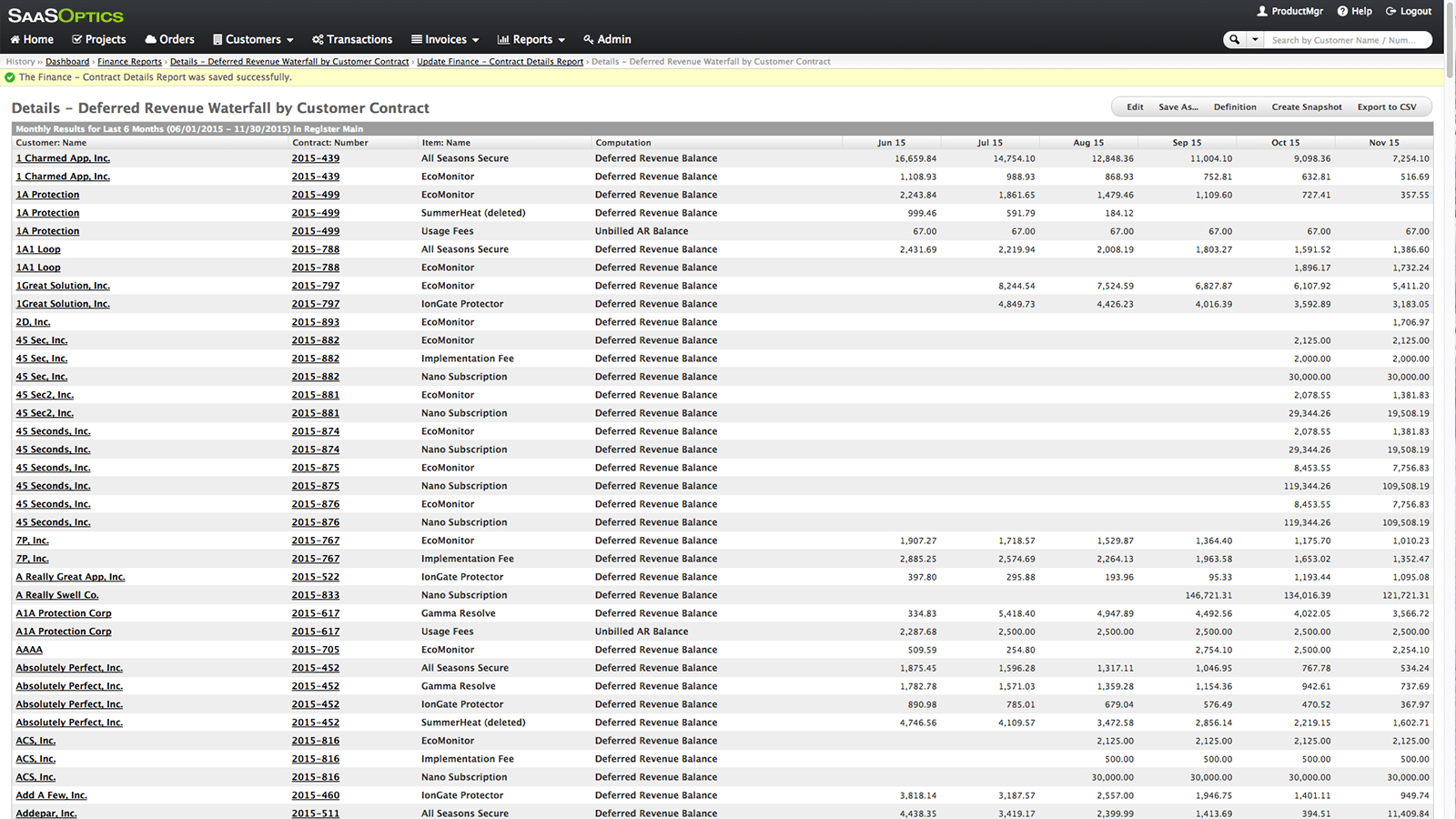

June 19, 2023 accruals and deferrals are essential accounting concepts that help ensure accurate financial reporting. Well, we have a solution to your problem. Saas revenue waterfall model, deferred revenue waterfall model, and revenue waterfall chart sound similar but actually have different meanings to finance teams.

Dtl/dta = temporary difference x tax rate. Deferred revenue, also known as unearned revenue, is a type of liability that represents a company's receipt of payment before it is fully earned. Or, are you having a lousy day drafting a payment schedule from scratch?

Project payment schedule template details file format google docs google sheets ms excel ms word numbers pages size: Identify the applicable tax rates for the business. Create a grey section for all your customers step 4:

I spent about five hours creating a free, saas revenue recognition and deferred revenue template in excel below. How would you create a earned revenue schedule formula for the following: Choose the icon, enter item, and then choose the related link.

It’s important to recognize the differences as you use these tools for analyzing and optimizing revenue, retention, billing, and cash flow. This article provides a list of balance sheet template that your readily use in accounting your business's deferred revenue. In row b, i would like the total eanred sales amount.

Identify temporary and permanent differences between accounting and tax treatments of the items in the financial statements. A deferred revenue schedule is a document that outlines the amount of deferred revenue, the timing of its recognition, and the conditions under which it will be recognized. In row a, i have 24 months of sales.

You are free to use this image on your website, templates, etc, please provide us with an attribution link. Download for free add to bookmarks discuss a saas excel model to help you forecast revenue waterfall in simple, automated charts. Column a has the sales amount for each month for the first year, and column b has has the sales amount for each month for the.

#1 this might be hard to explain without a spreadsheet. Examples of deferred revenue. Why companies record deferred revenue the simple answer is that they are required to, due to the accounting principles of revenue recognition.

Deferred revenue is money received by a company in advance for products or services that have not been delivered. A4 & us download now are you looking for a payment schedule template for your project today?