Underrated Ideas Of Info About Income Tax Calculation Excel Sheet

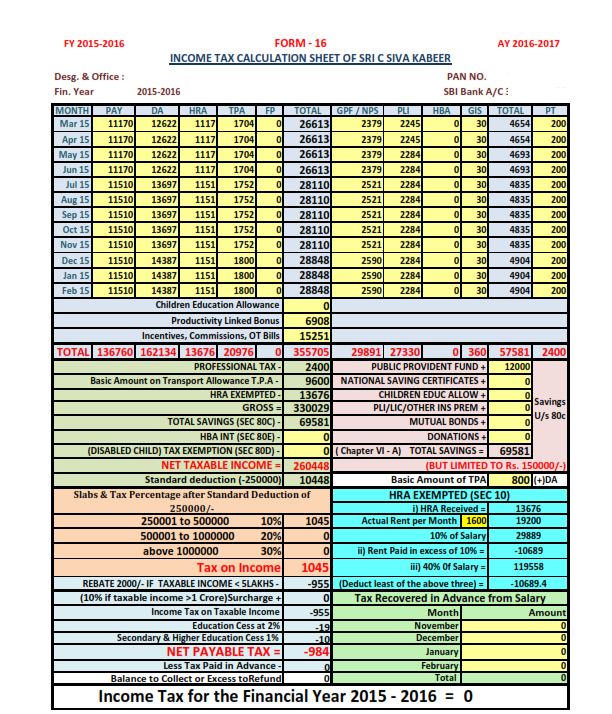

Download the income tax calculator with name:

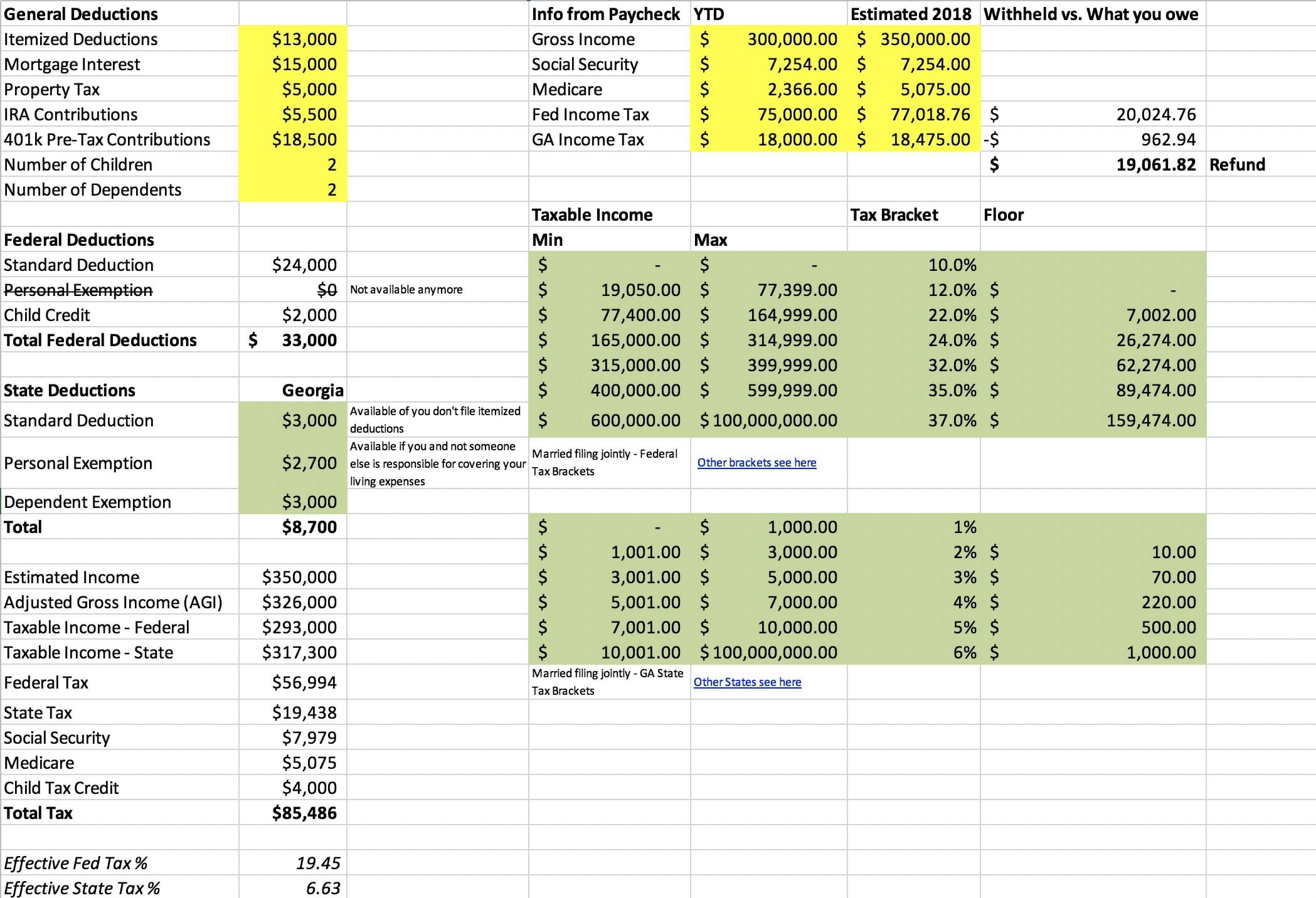

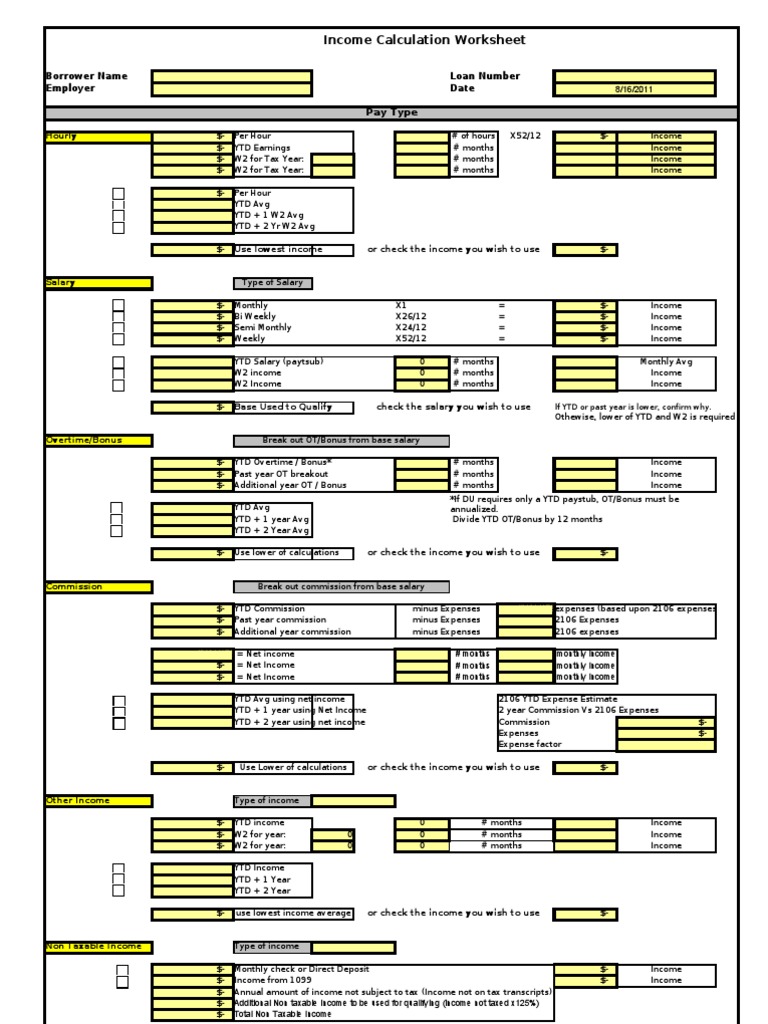

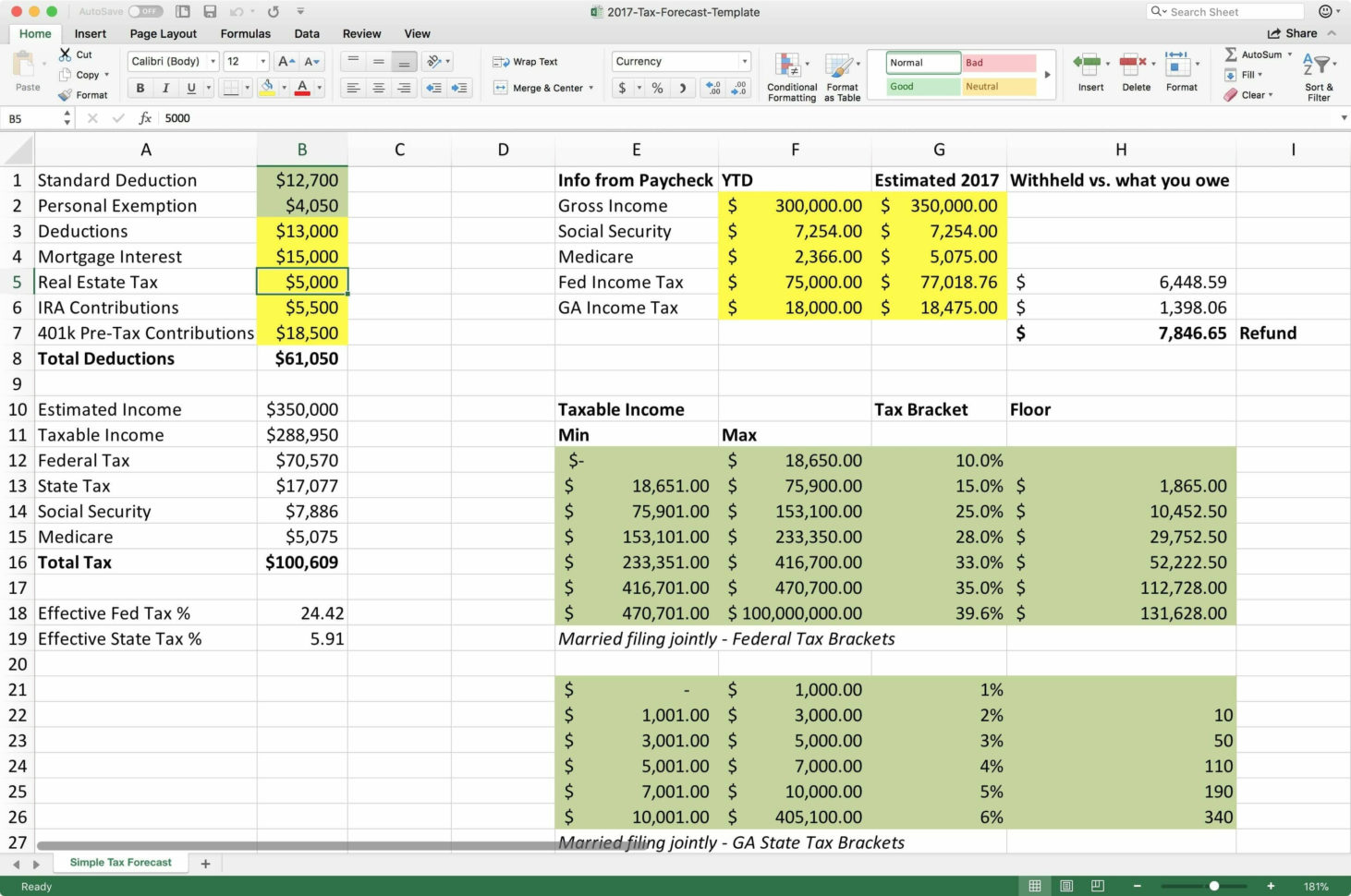

Income tax calculation excel sheet. And fill in your income details. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary calculation variables. You always have the option of creating a personal federal income tax calculator spreadsheet.

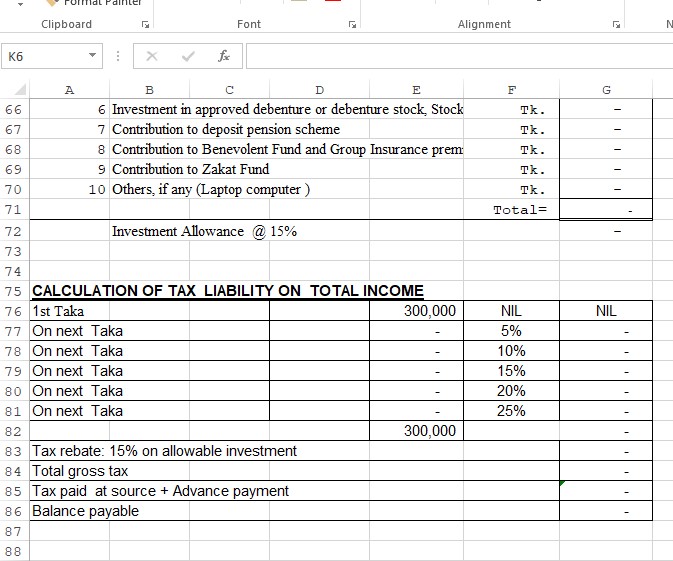

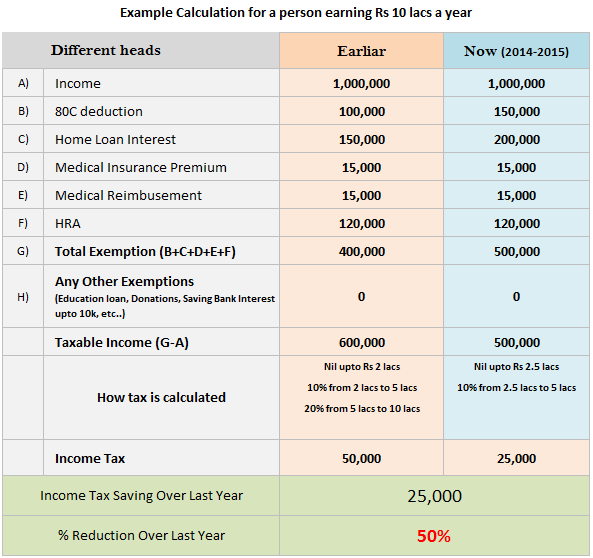

Excel income tax calculator to download: Above old vs new tax regime calculator in excel will help you to calculate income tax with both old and new tax regime slab rates. Under the old tax regime, the income tax calculation for an income of rs.

Provide investments including standard deduction,. Create two rows to calculate. Make your own federal income tax spreadsheet.

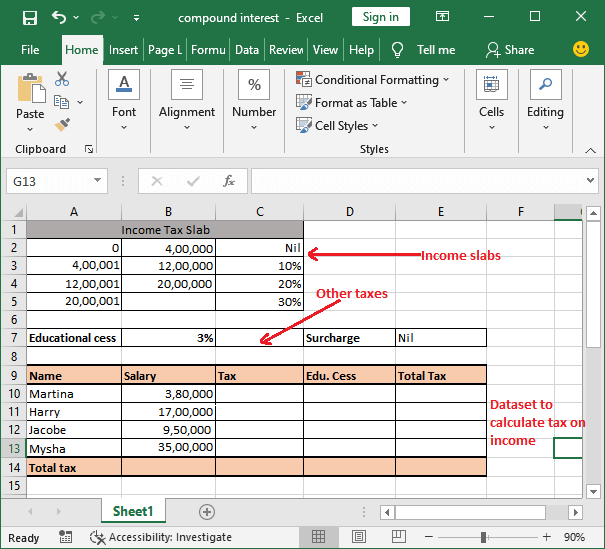

It is designed to simplify. Here are the key steps to take when setting up your excel spreadsheet for income tax calculations: To compute income tax in excel by using this method, see the following step.

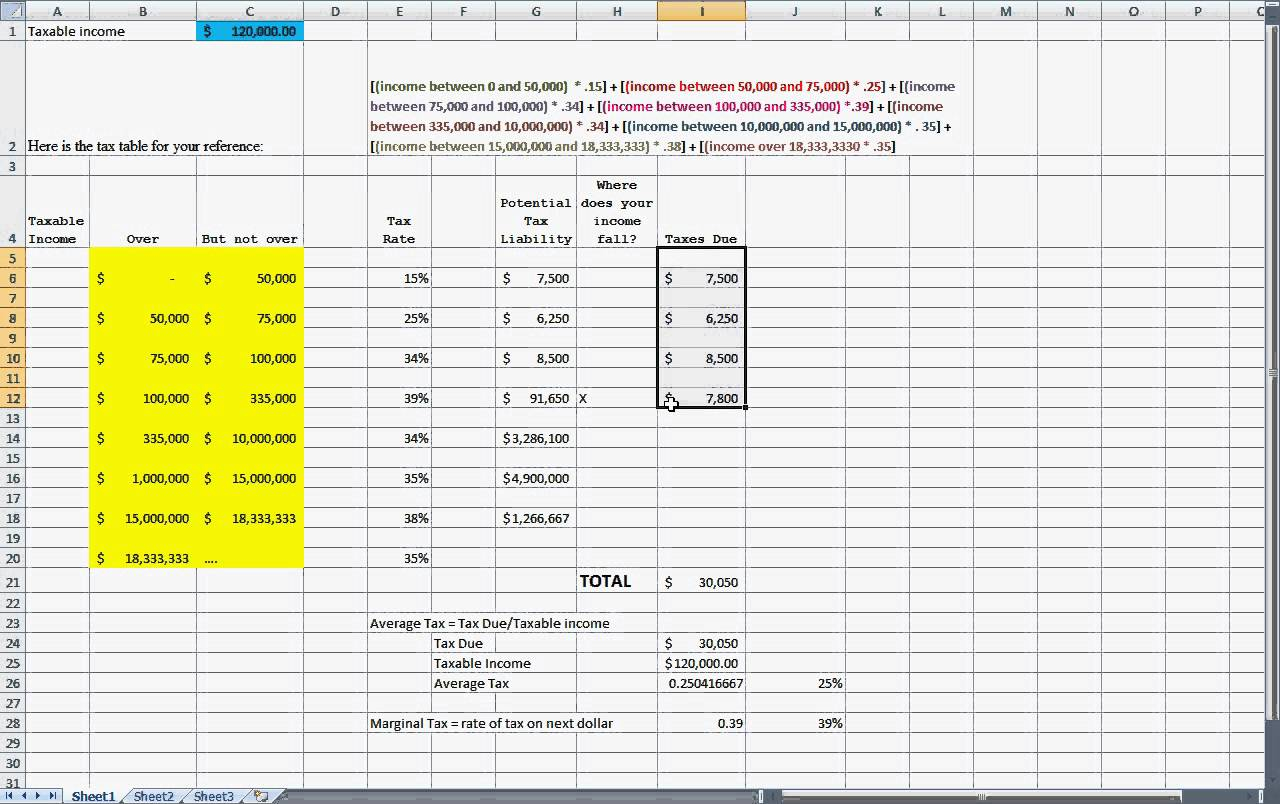

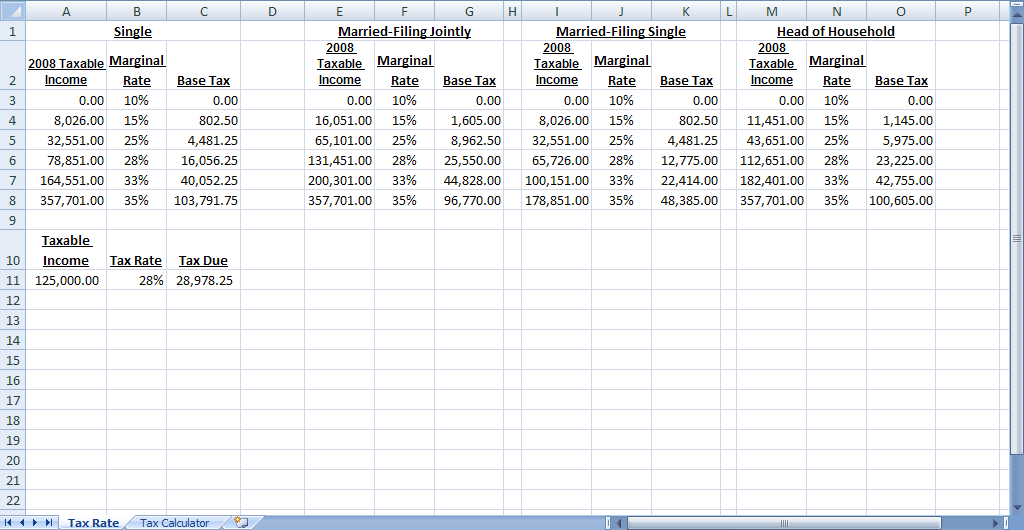

How to calculate income tax in excel using if function: To calculate income tax in excel, you need to set up the spreadsheet properly to ensure accurate calculations. We want to enter a taxable income and have excel compute the tax amount, the marginal tax rate, and the effective tax rate.

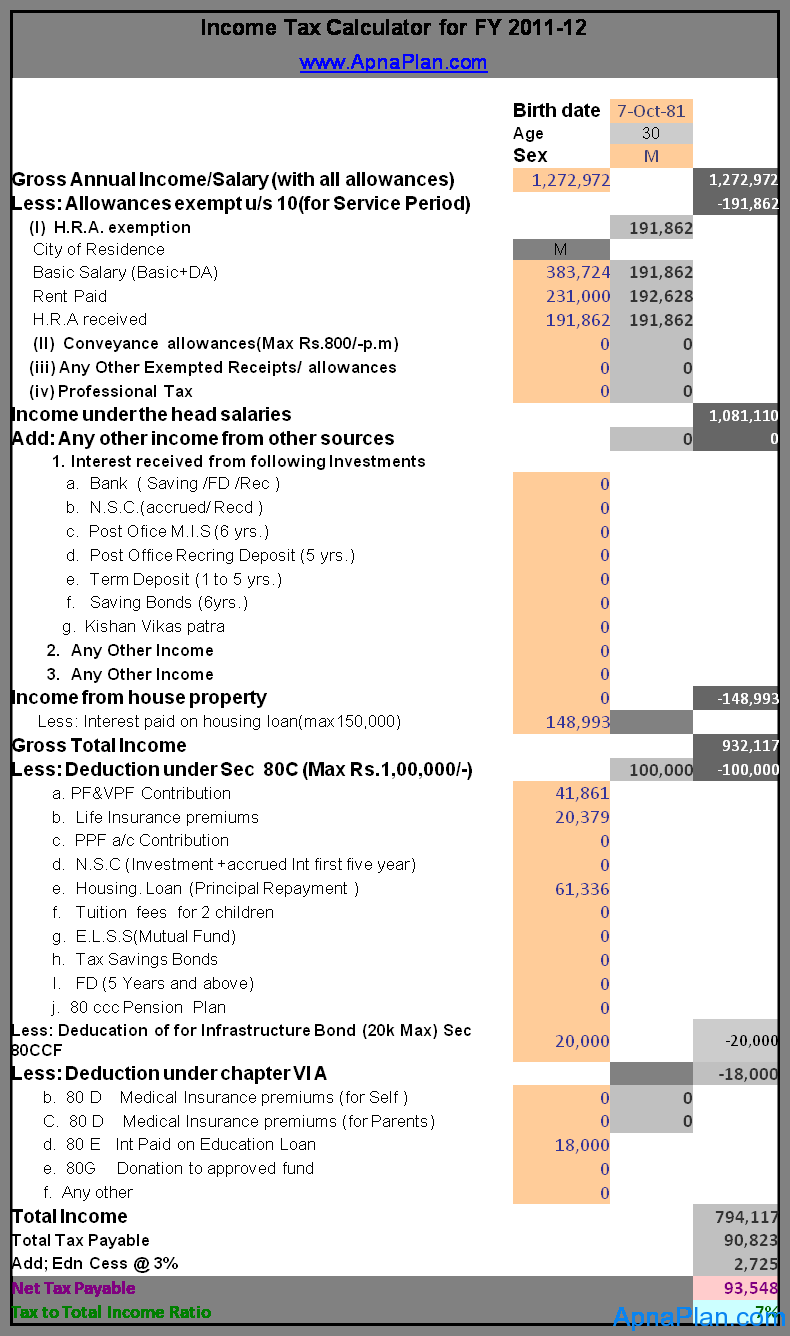

When you receive the spreadsheet download, you need to choose your age (for the relevant. An excel income tax calculator (excel utility) is a tool created in microsoft excel that helps individuals calculate their income tax liability. Firstly, we will calculate taxable income from gross income like the.

The calculator is for people of age below 60. Microsoft excel offers several standard functions that can be used to calculate your effective tax rate using your income breakdown by tax bracket. Choose between old and new tax regime, provide income, investments and tds details to get.

Here's how you can do it: How the south african tax spreadsheet calculator 2024/ 2025 works. Using tax calculation formula in excel (provided above), you can calculate tax liability based on below steps:

Organizing income and expenses data begin by creating a new excel. A fixed tax amount imposed on a person’s income by the central government is called. Add your gross income, your total exemptions, and deductions.

5% tax calculation on income between 2.5 to 5 lakh in old.

![Tax Calculation 202223 Excel Calculator [VIDEO] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/02/tax-1.webp)