Glory Tips About Sole Trader Bookkeeping Spreadsheet

Sole trader accounting refers to managing and reporting the financial transactions of a sole trader — essentially an individual who runs their own business.

Sole trader bookkeeping spreadsheet. There is no need to track exact dates or bank balances. You can choose between manual bookkeeping, spreadsheets, or accounting software. As a sole trader, bookkeeping and managing your accounts are the key tasks you have to deal with.

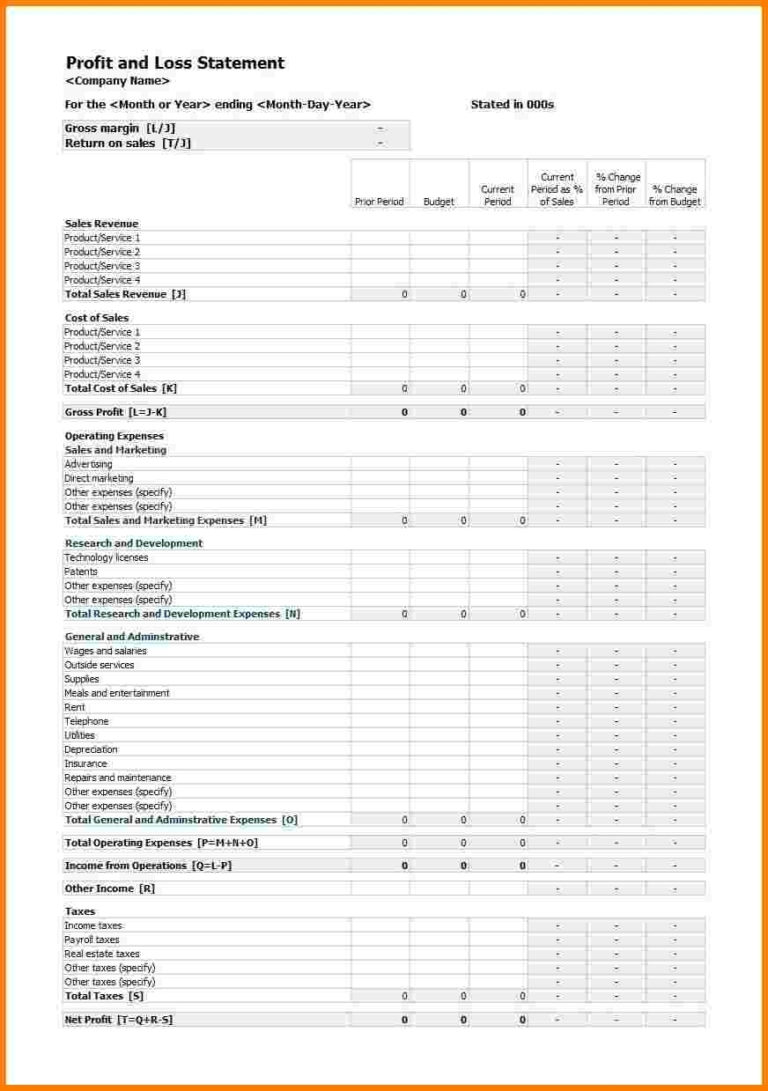

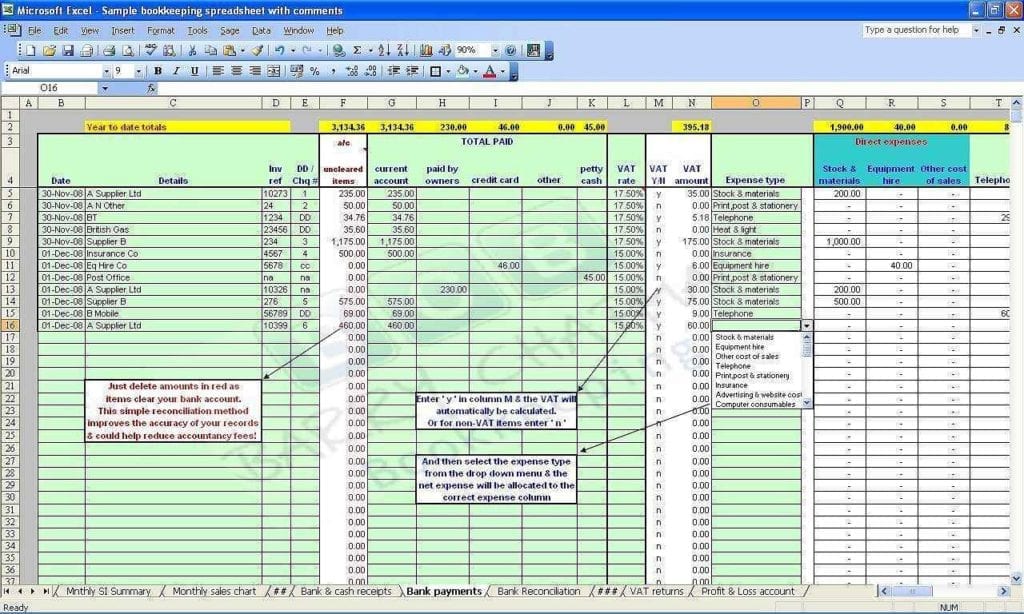

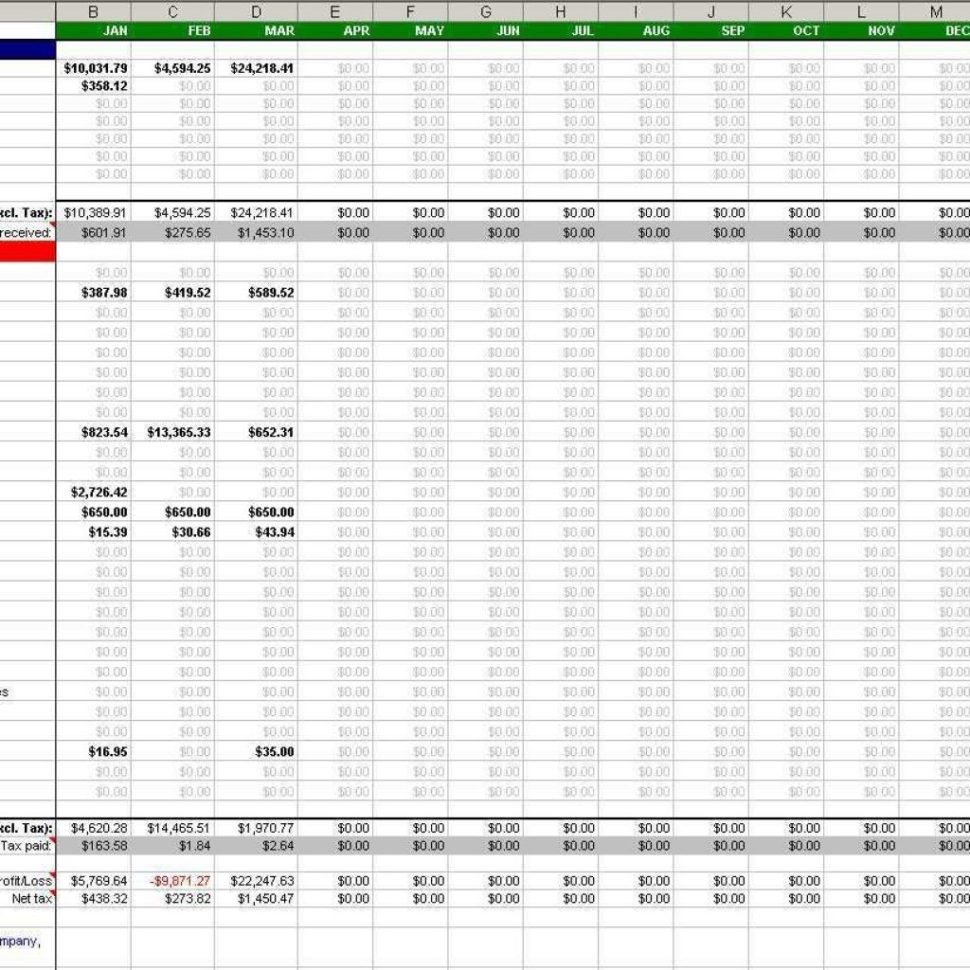

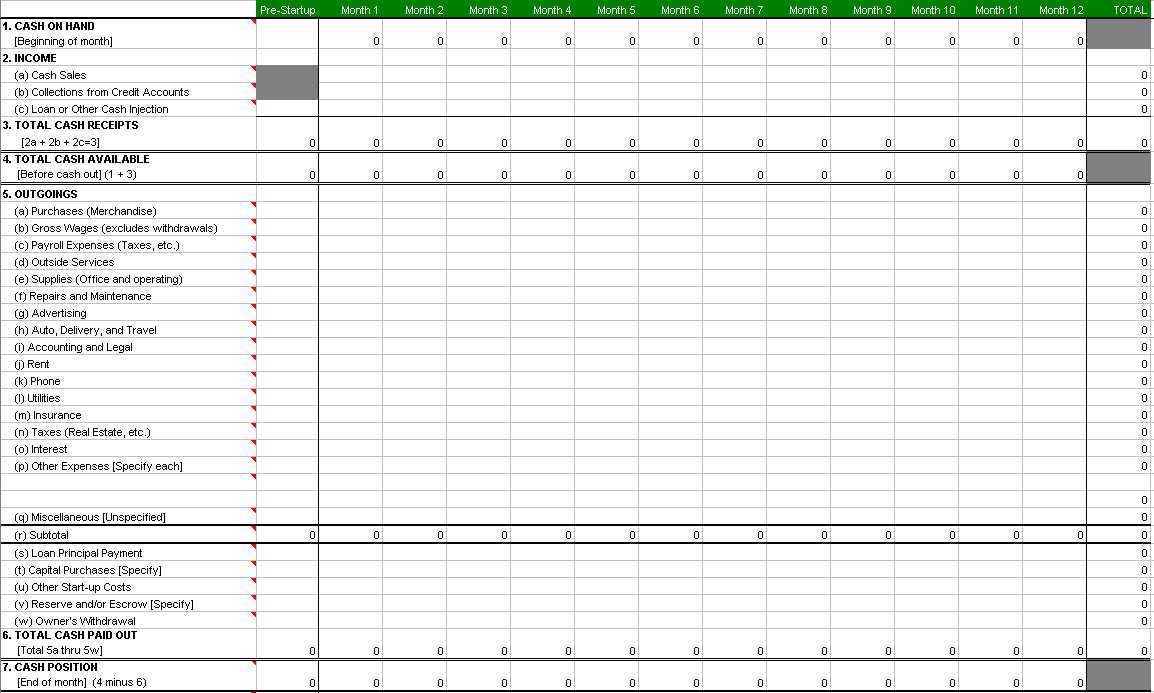

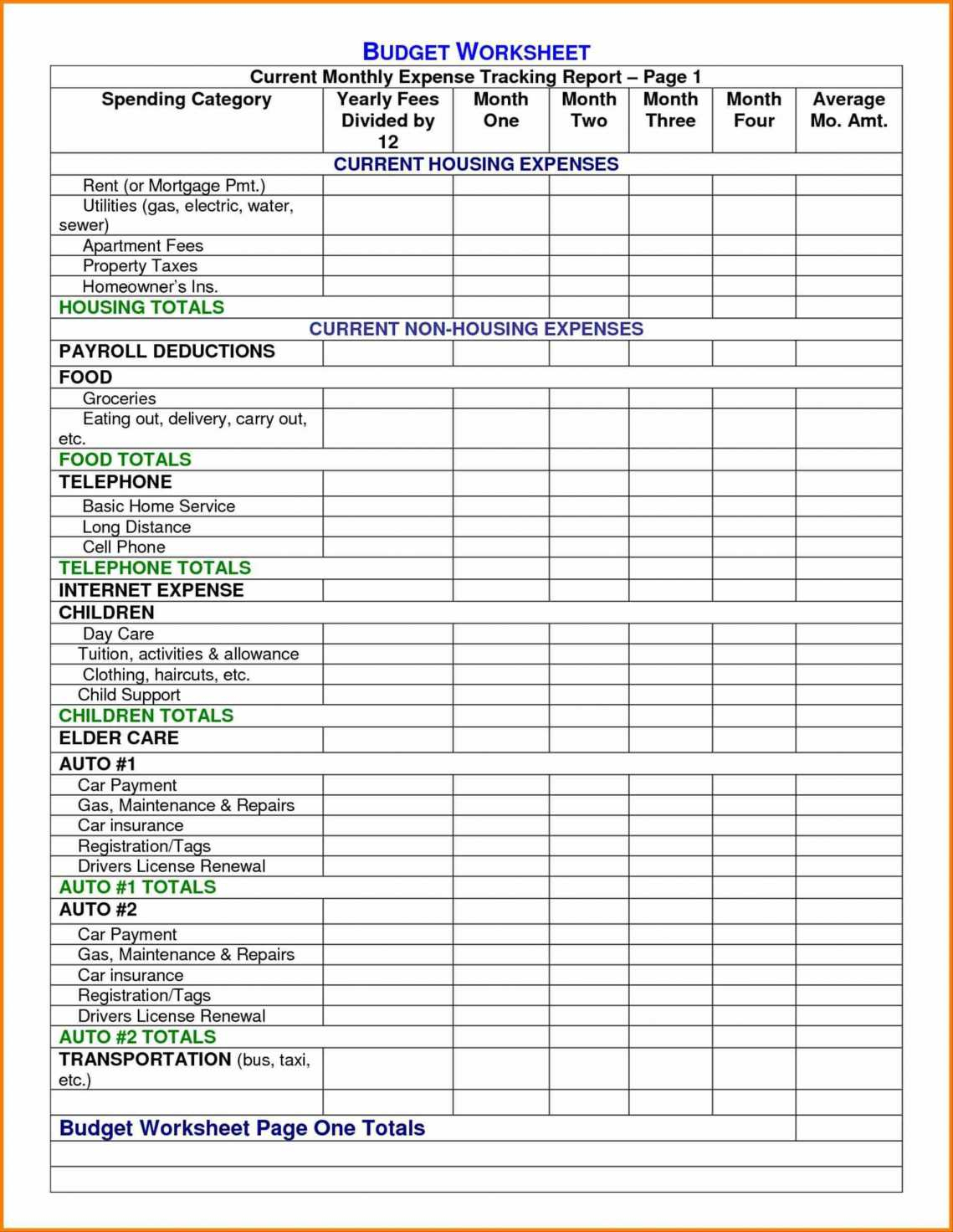

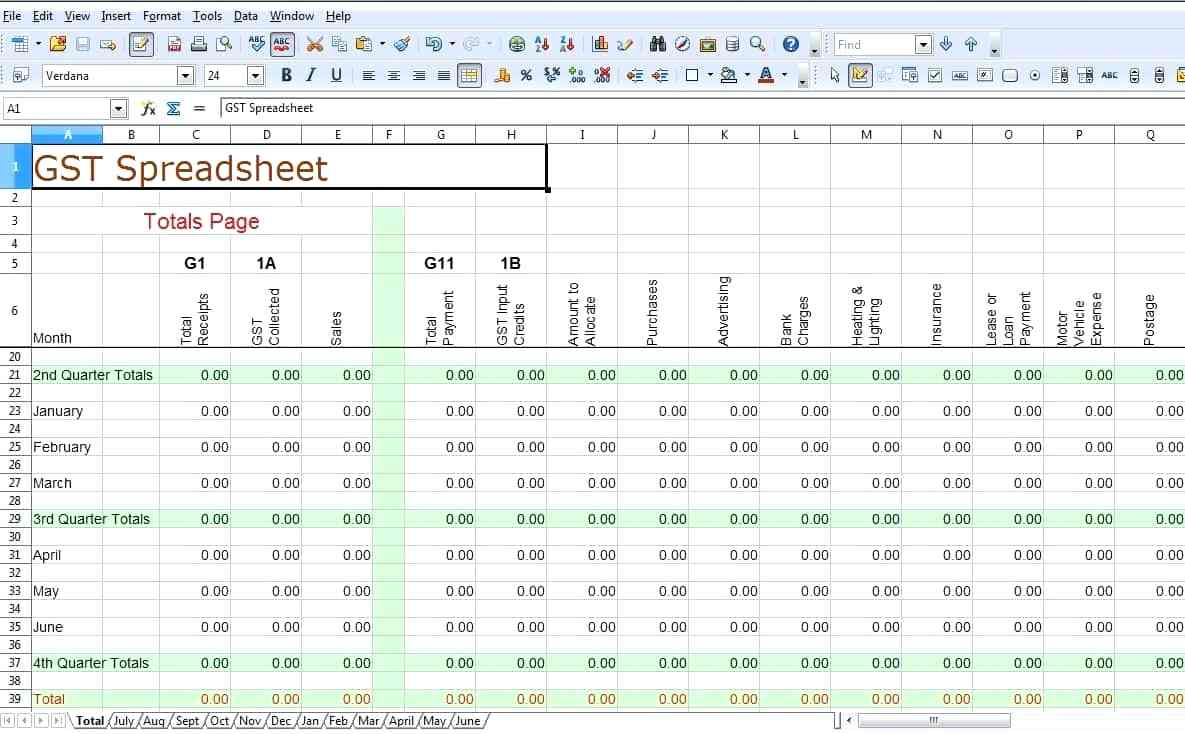

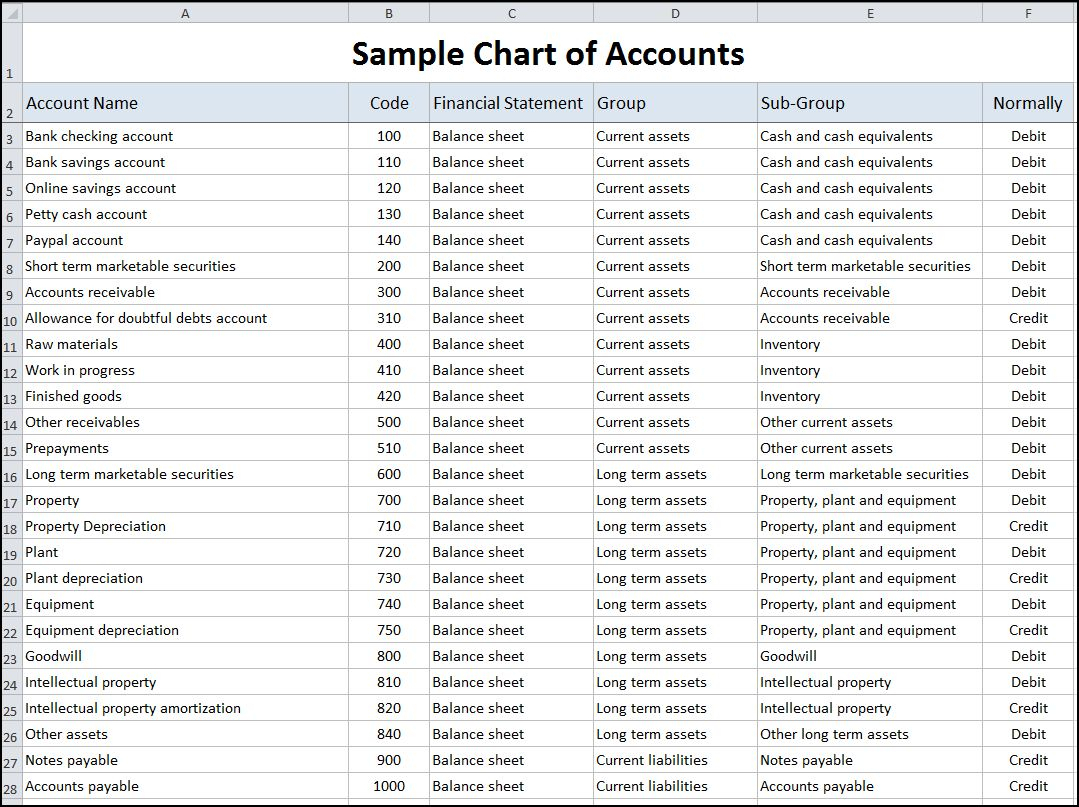

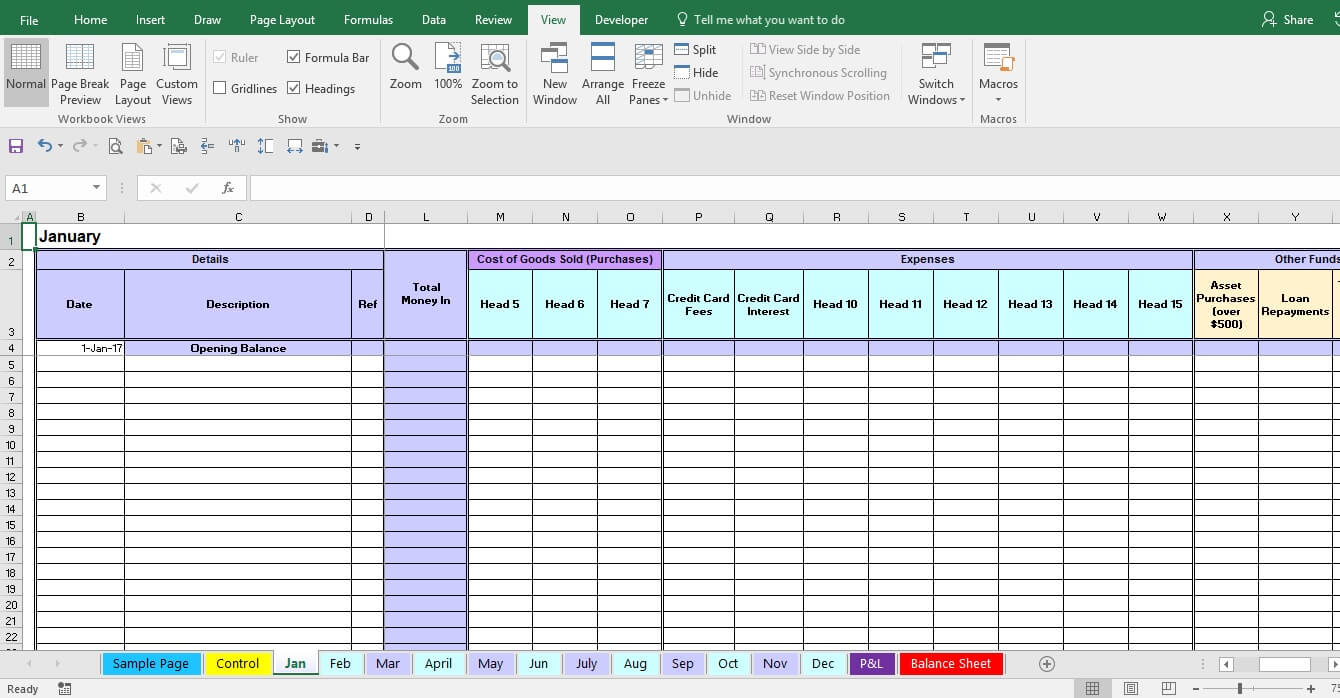

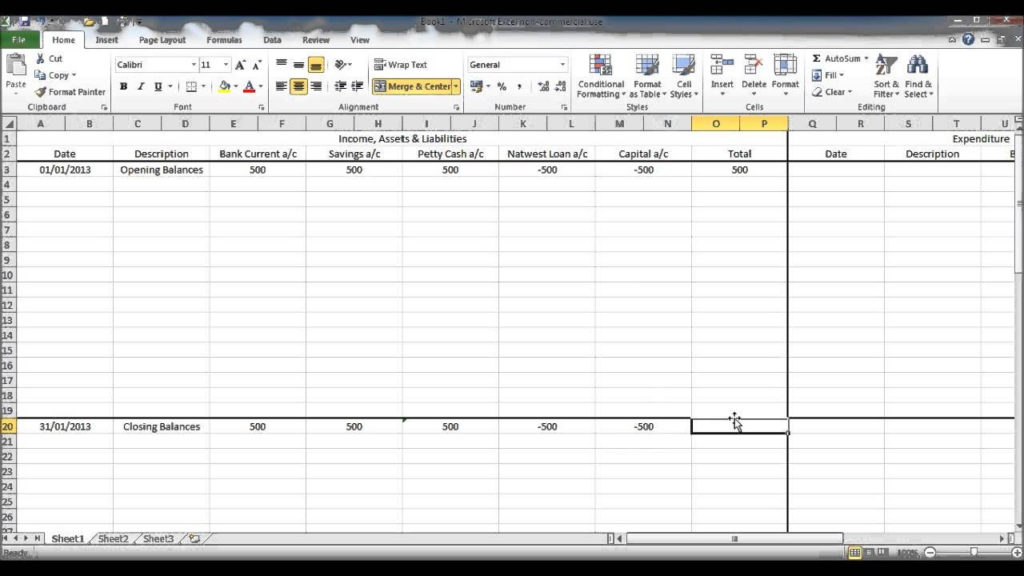

Enter the accounting period the year in which you are. They include cashbook, budgeting, cash flow statement, petty cash, sales receipts, depreciation, stock record card, bank reconciliation and more. Navigate the intricacies of sole trader bookkeeping with our handbook and discover the principles, tax obligations, best practices, and essential tools for a thriving.

It simply allows for the recording of transactions in a long list. Regardless of the method you choose, consistency and accuracy are essential. If you don't have it, look for the ms office deal from software4students for around £35.

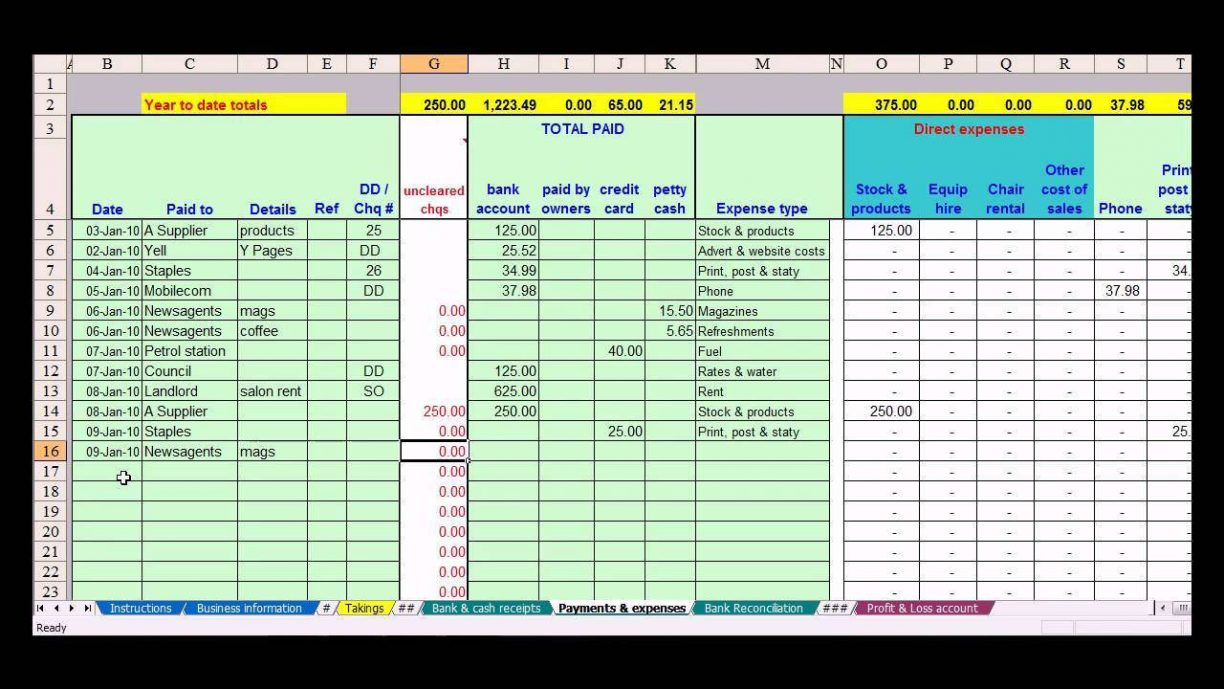

1 january 2012 at 9:18pm. Bookkeeping as a sole trader involves recording all money coming into and leaving your business throughout the year. Enter the name of the company or business whose records are going to maintain in this spreadsheet.

23 free small business bookkeeping templates try smartsheet for free by andy marker | april 27, 2022 we’ve collected 23 of the top bookkeeping templates. Are you confident using a computer, but don't have the funds for an accounting package? What is sole trader bookkeeping?

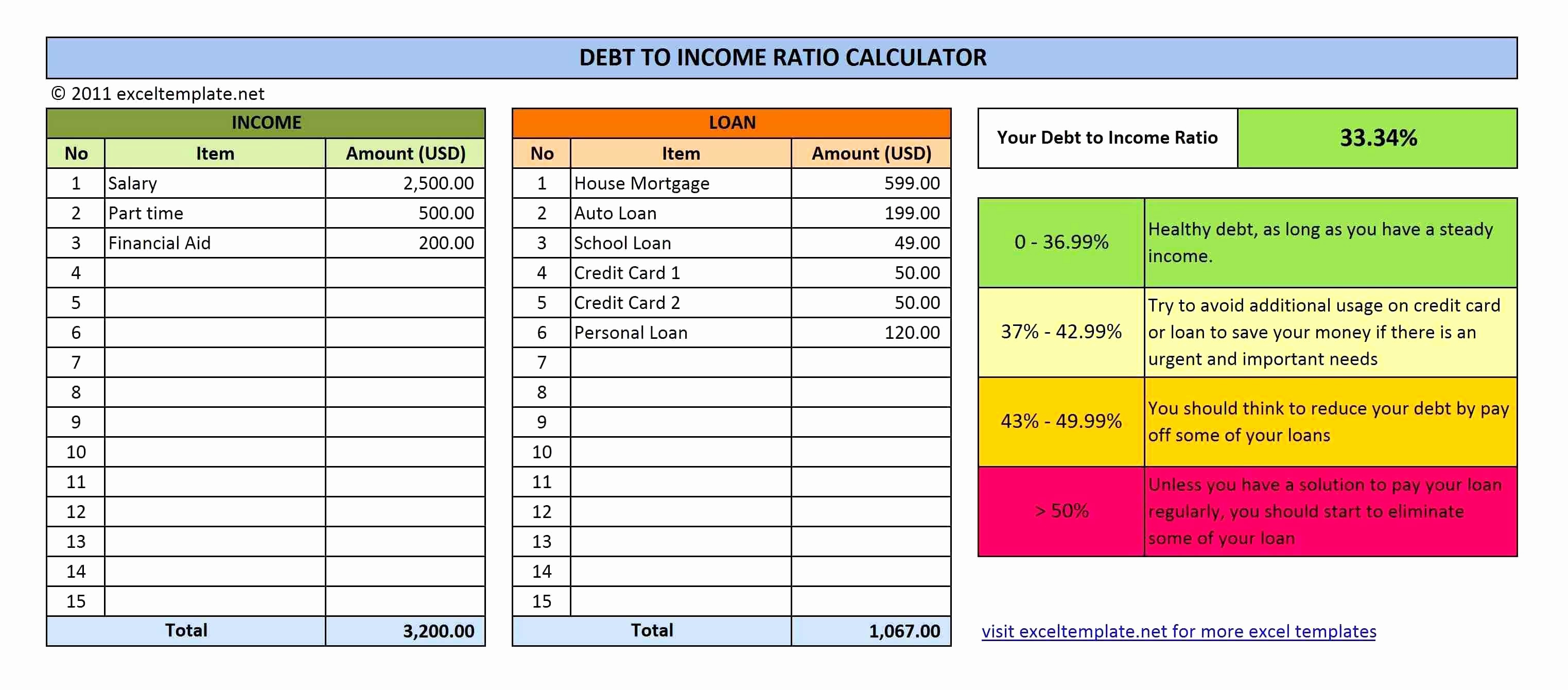

Sole traders must pay tax on their income and submit self. Can i do my own bookkeeping? How to do your bookkeeping as a sole trader 3.

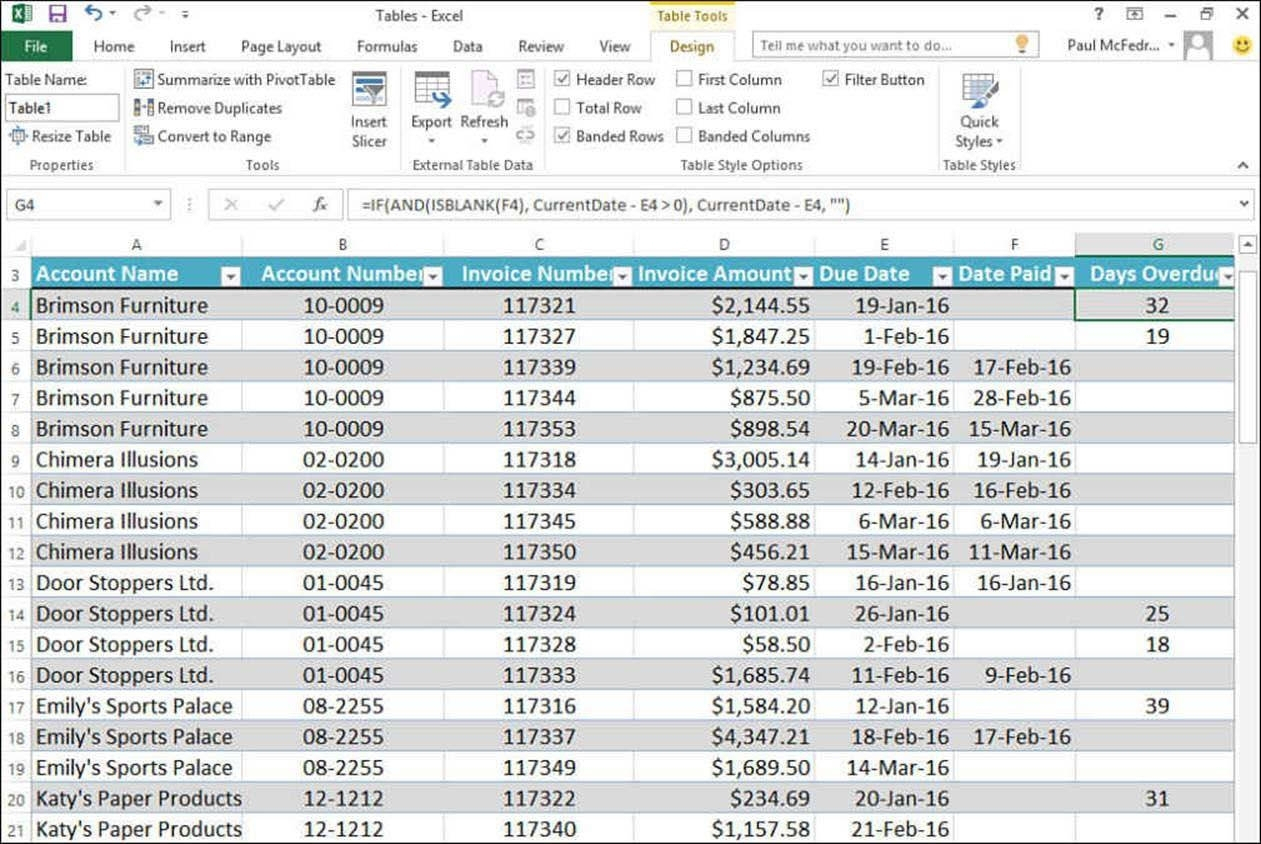

How to create a sole trader bookkeeping in excel: If you can grasp the. This means keeping careful records of:

Bookkeeping software built for your sole trader business freshbooks is the perfect fit for a sole trader, whether you’ve just launched a new business or have been running your.