Recommendation Tips About Stock Cost Basis Spreadsheet

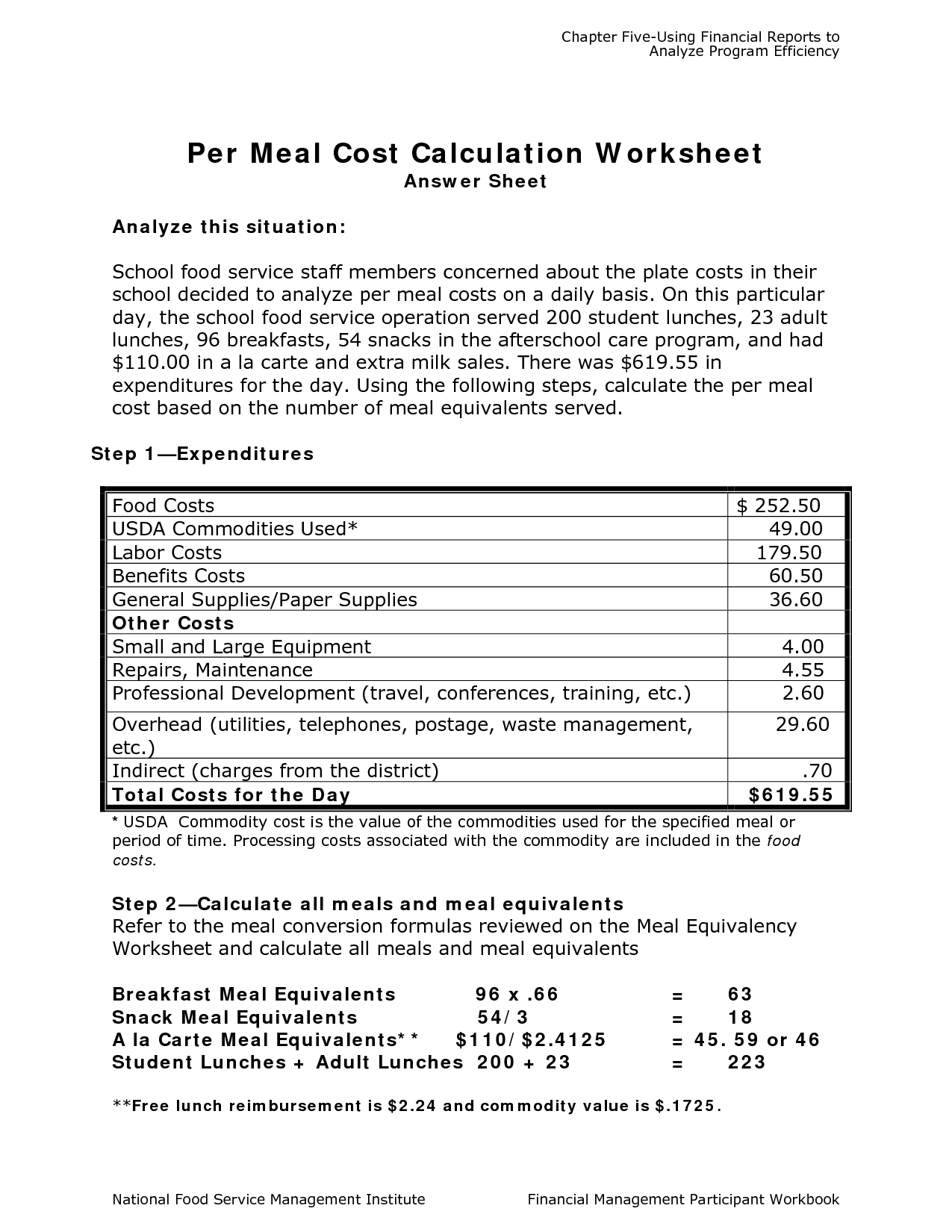

The basis is your average cost of the original investment.

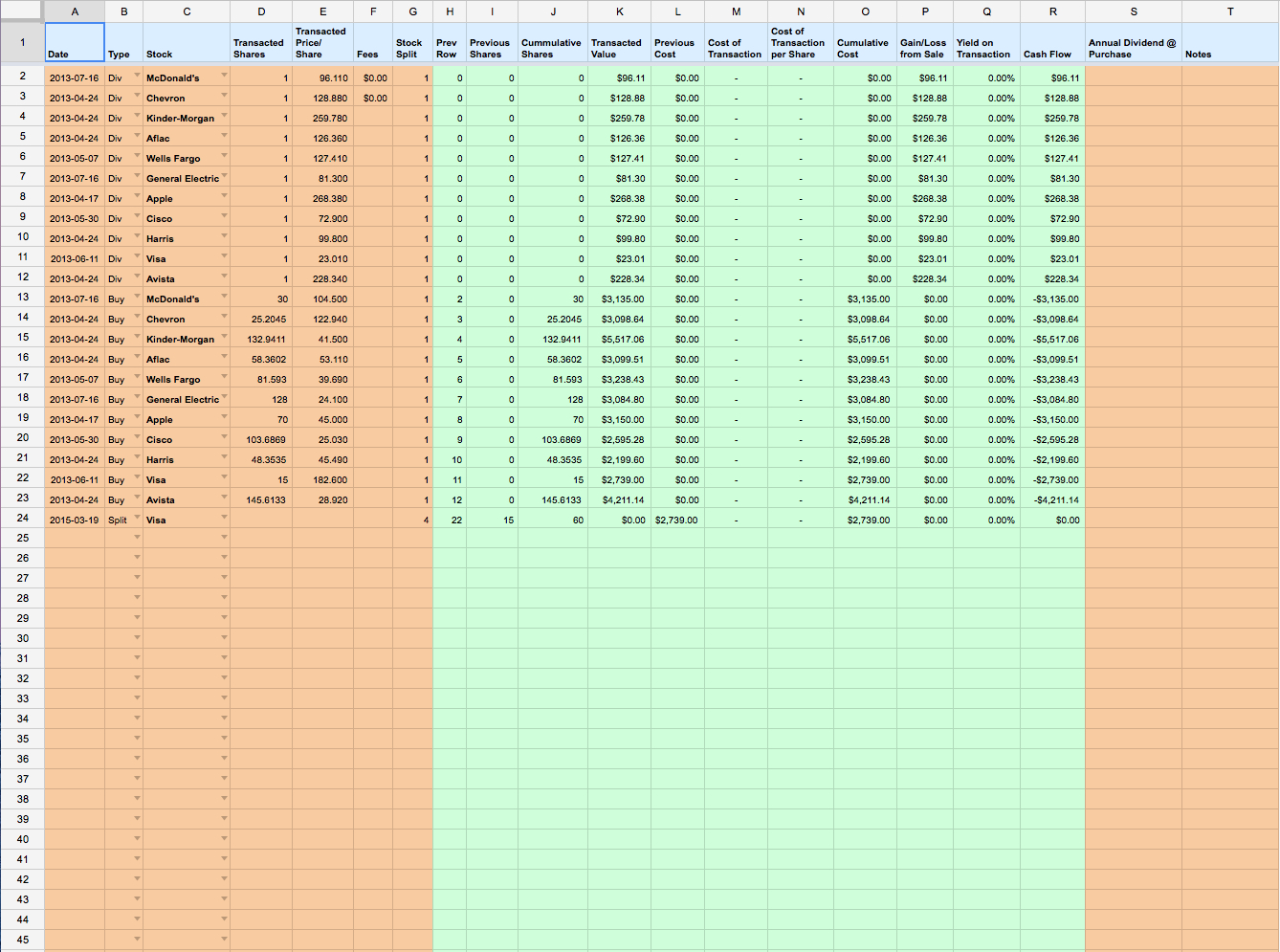

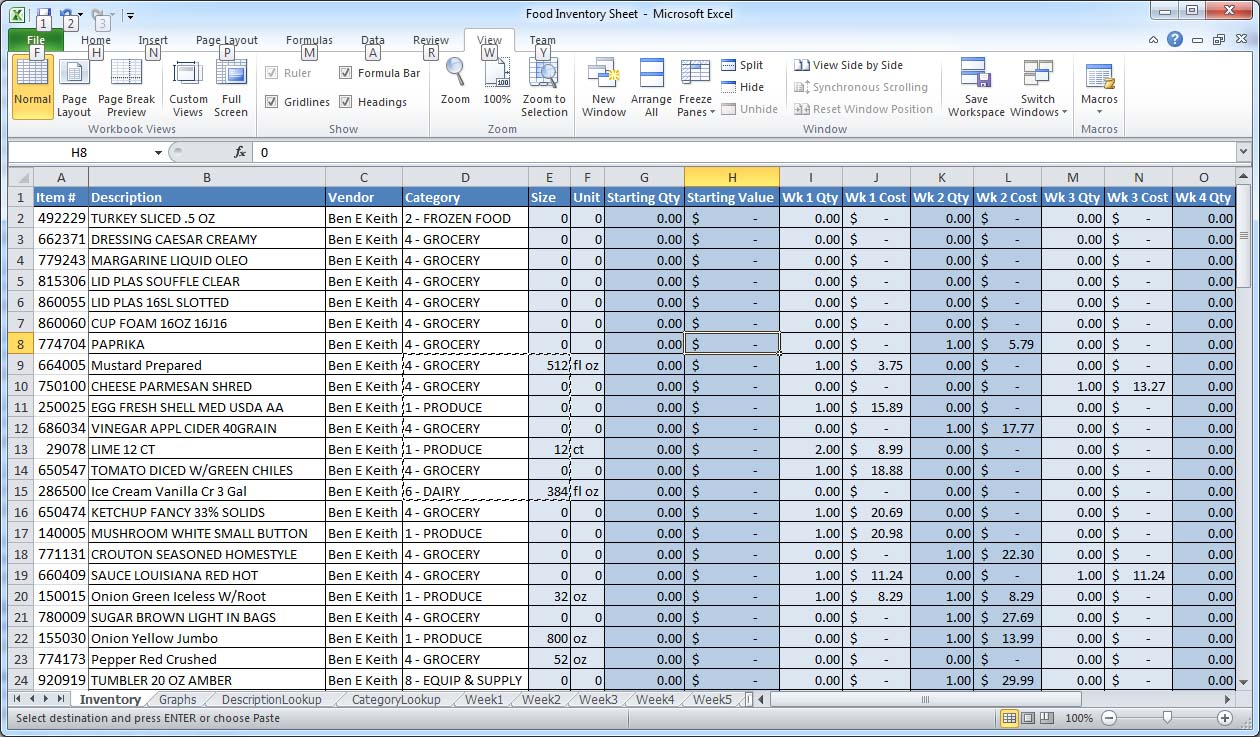

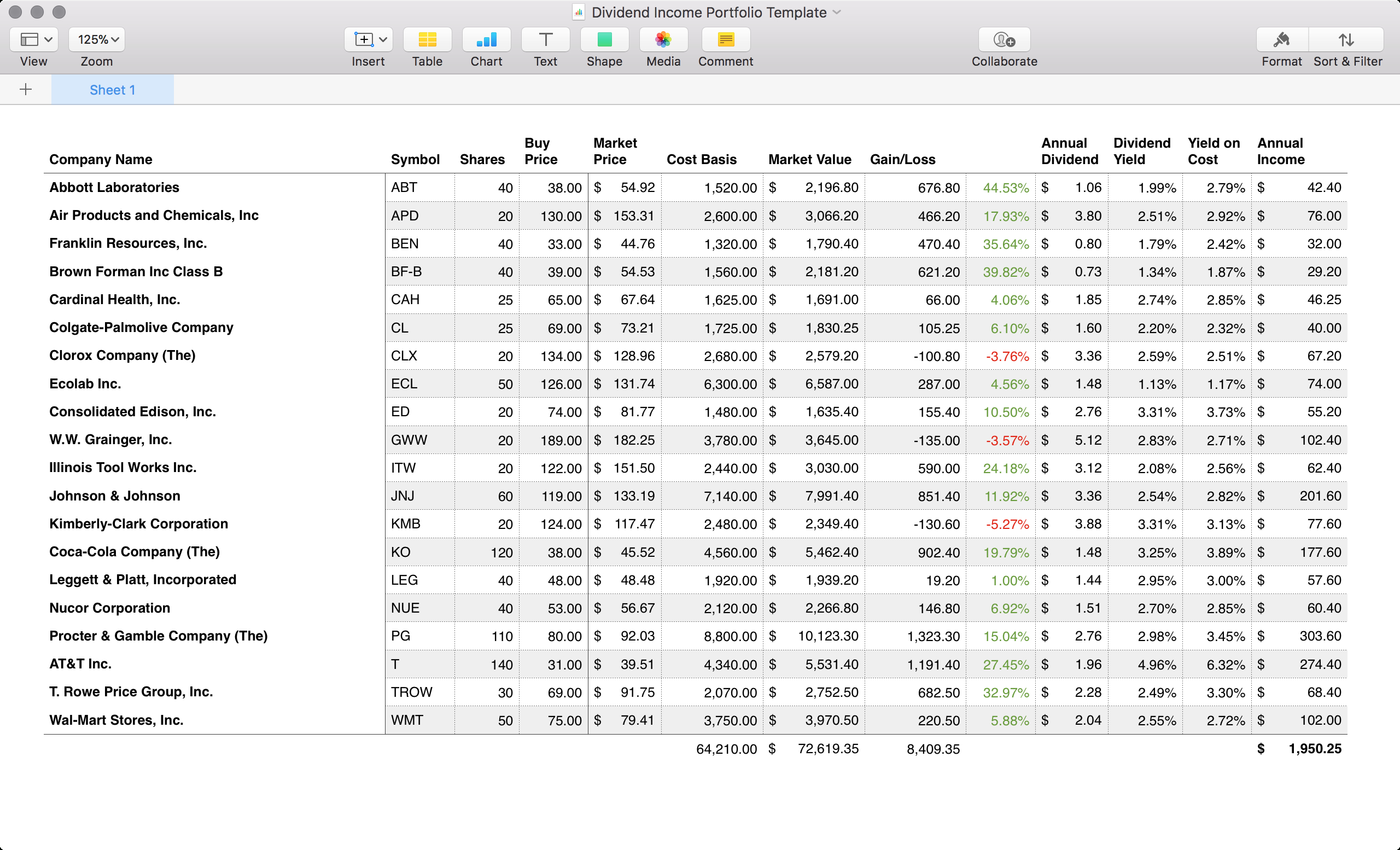

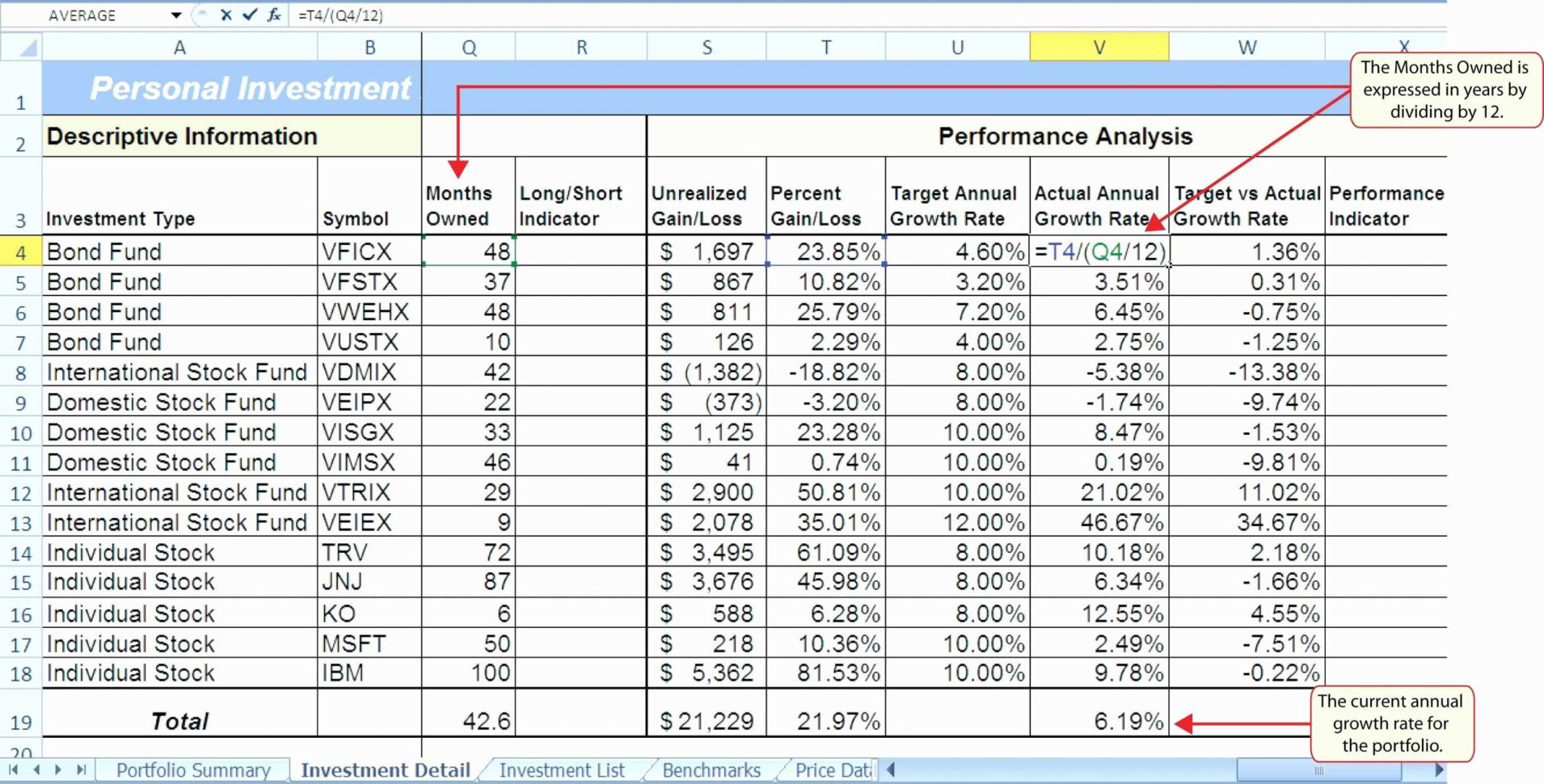

Stock cost basis spreadsheet. By entering the number of shares (units) and share price (cost per unit), you. This spreadsheet is designed to help you keep track of your adjusted cost basis (acb) for your stocks, mutual funds or etfs. Cost basis per share (average), just need a formula on how to calculate my average cost basis per share to put into c.

How to implement fifo method in google sheets to compute cost basis in stocks investing conclusion in this post, i have explained how to. You can download version 1.1 here. Typically, when you purchase shares of stock, the cost basis is simply the price you paid for each share.

When we talk asset (stocks, etfs, mutual funds, etc.), the basis is the cost toward this time of purchase. Intro to cost basis basic. Them can download version 1.1.

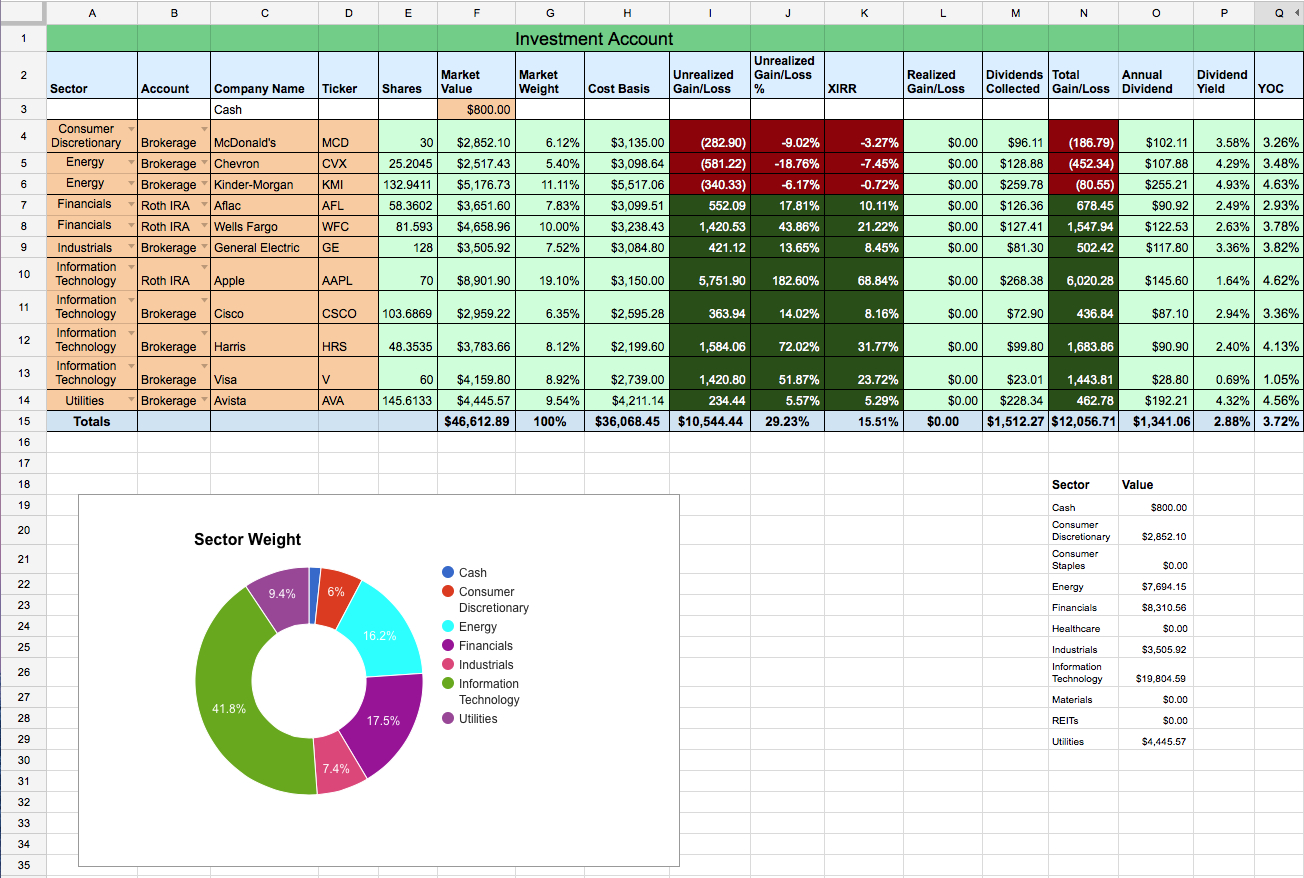

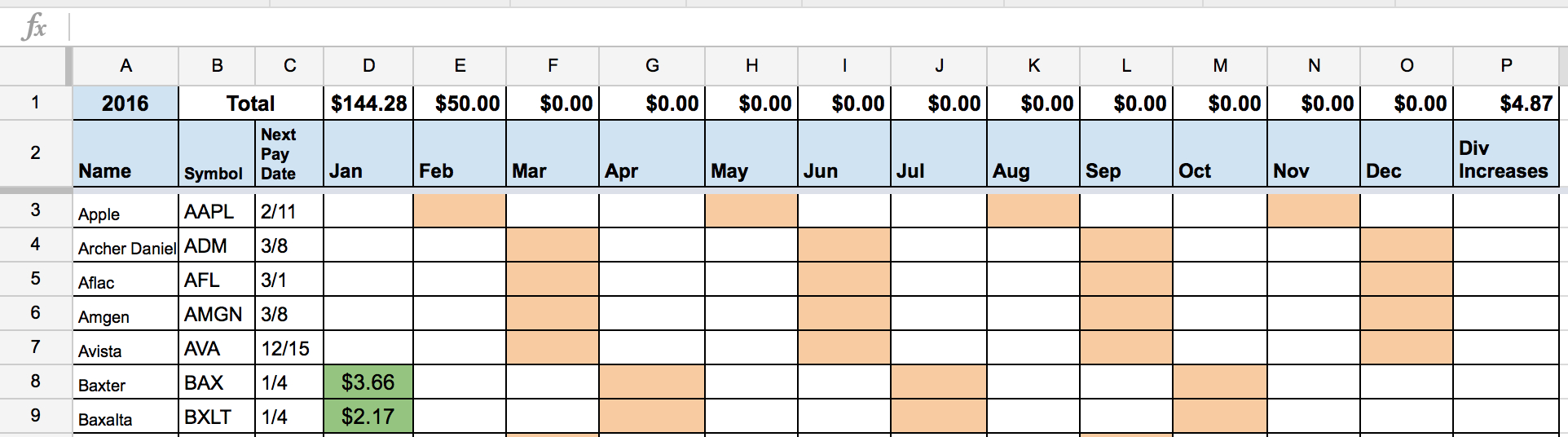

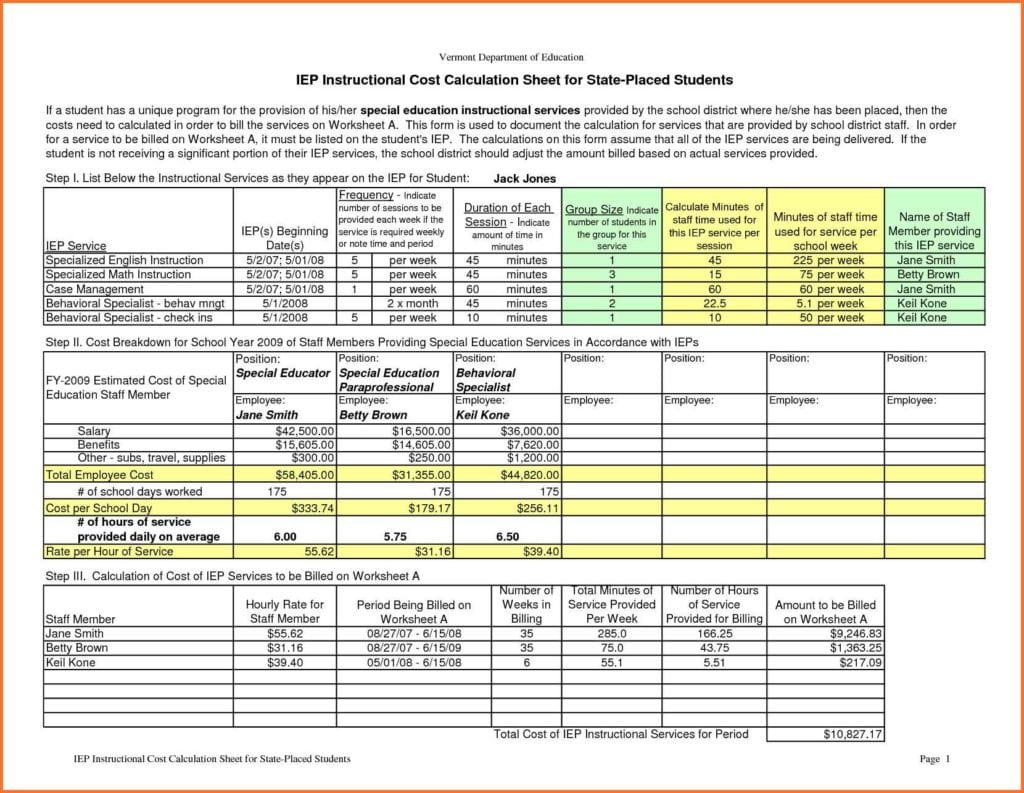

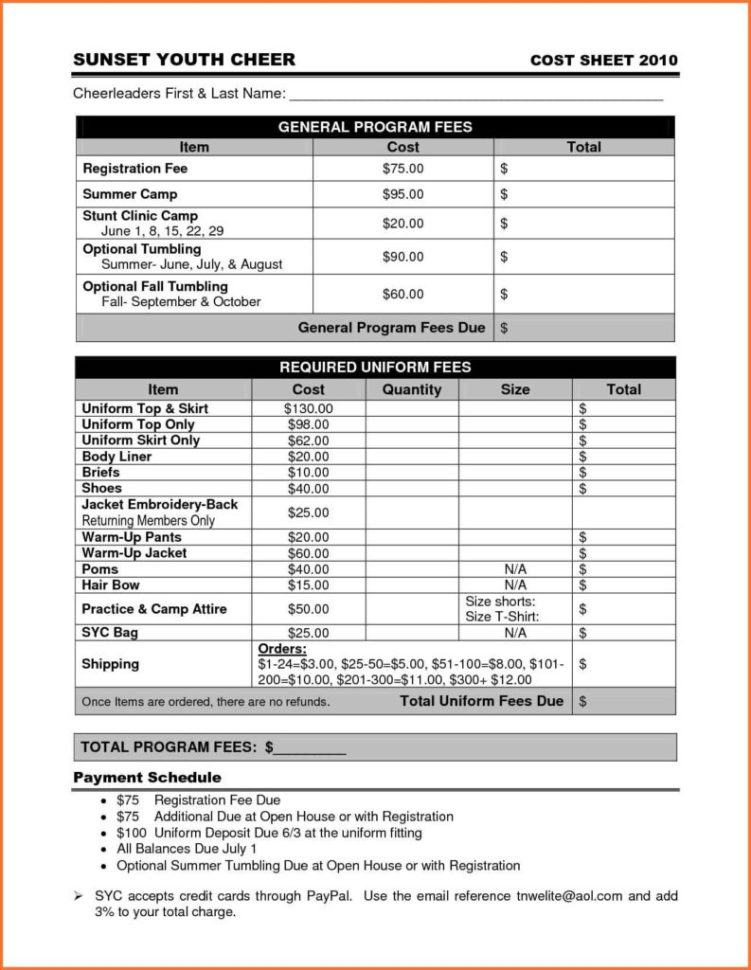

Use this software to keep track of the cost basis of taxes on your individual lots and to calculate or map out your dividend schedule. If yes, use this worksheet below to calculate the allocation of your cost basis between at&t inc. This spreadsheet is designed to help she keep track of your adjusted cost basis (acb) for to equity, interactive funds or etfs.

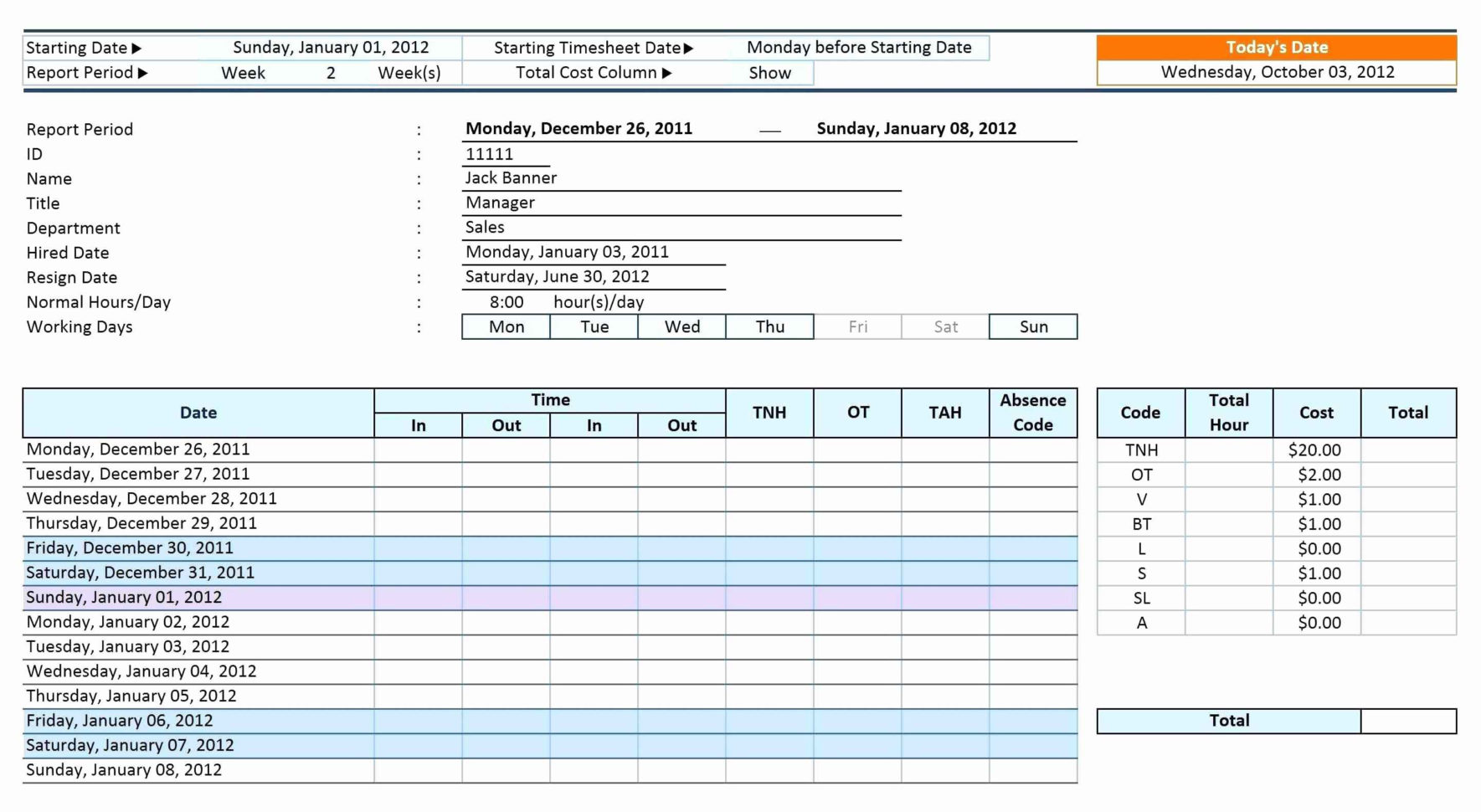

With the cell still selected, open the data tab, and then click. With this method for each sale transaction we calculate average cost basis per share using information. However, this isn’t too effective for when.

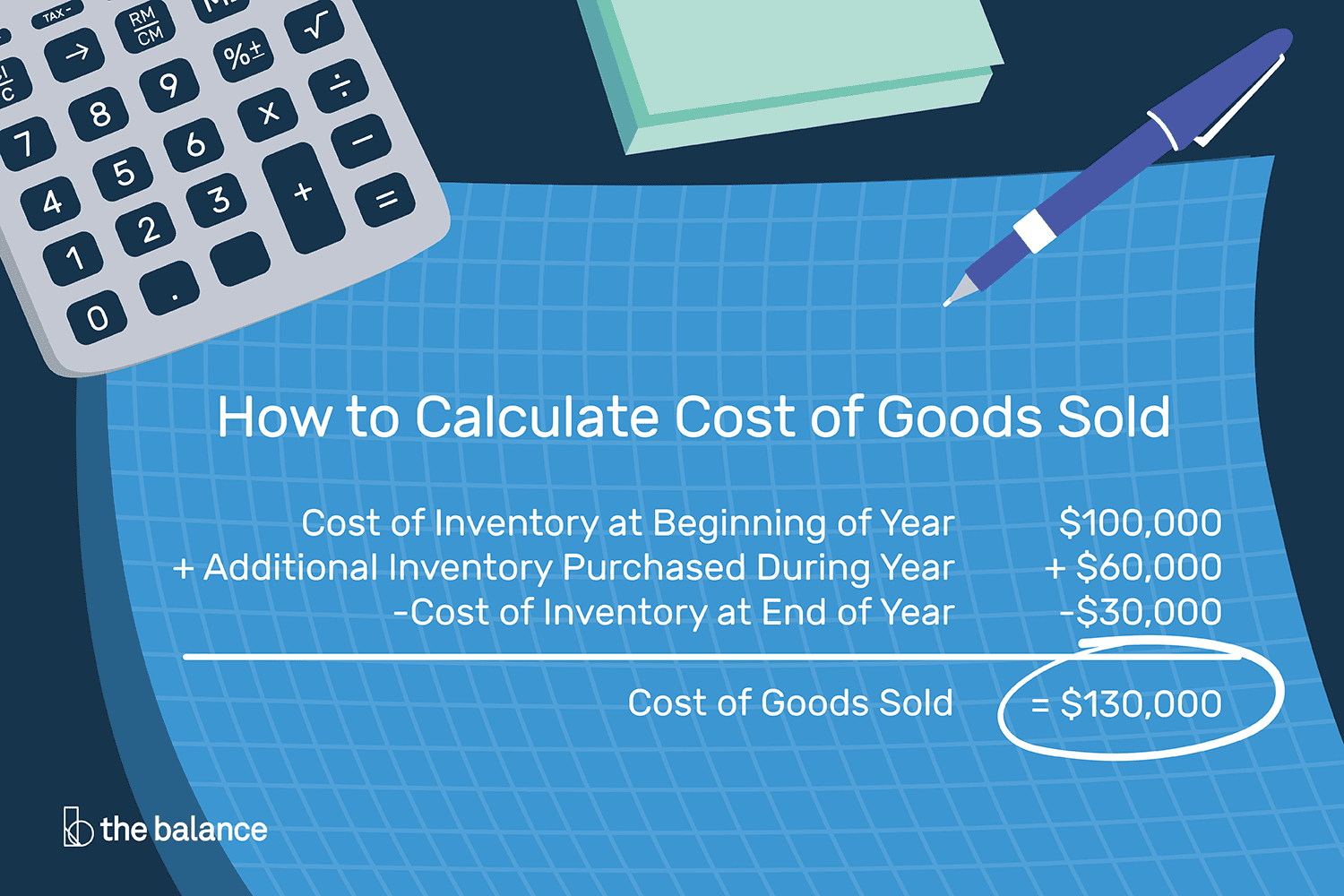

The cost basis calculator automatically calculates the cost basis and number of shares held for requested securities. Say you purchased 10 shares of xyz for $100 per share. For tax purposes, the method of computing the gain or loss on investments must be elected and consistently applied.

Open your spreadsheet and type a piece of information, like a company name or stock symbol. Cost basis is used to calculate the capital gains tax rate, which is the. The last cell, gain/loss can be figured out by subtracting the cost basis from the sell price and then subtracting the final commission cost:

Free calculators for computing cost basis and gain/loss on cash in lieu of fractional shares resulting from spinoffs, stock splits, stock mergers, stock mergers with cash to boot. Cost basis is the original value or purchase price of an asset or investment for tax purposes. With this stock cost basis calculator, you can determine the total cost basis of your investment.

Portfolio slicer currently calculates cost basis using average method. If you acquired your at&t inc.