Top Notch Tips About Depreciation Schedule Excel Template

Free download depreciation schedule template in excel format.

Depreciation schedule excel template. Download a free monthly depreciation schedule excel template free download to make your document professional and perfect. Excel 2007 or later, office 365, & excel for ipad/iphone. Depreciation is one of the most important features for real estate.

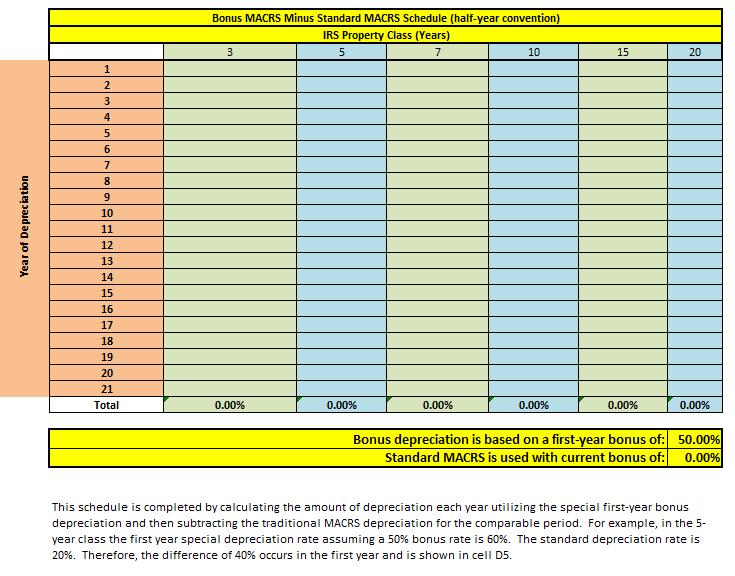

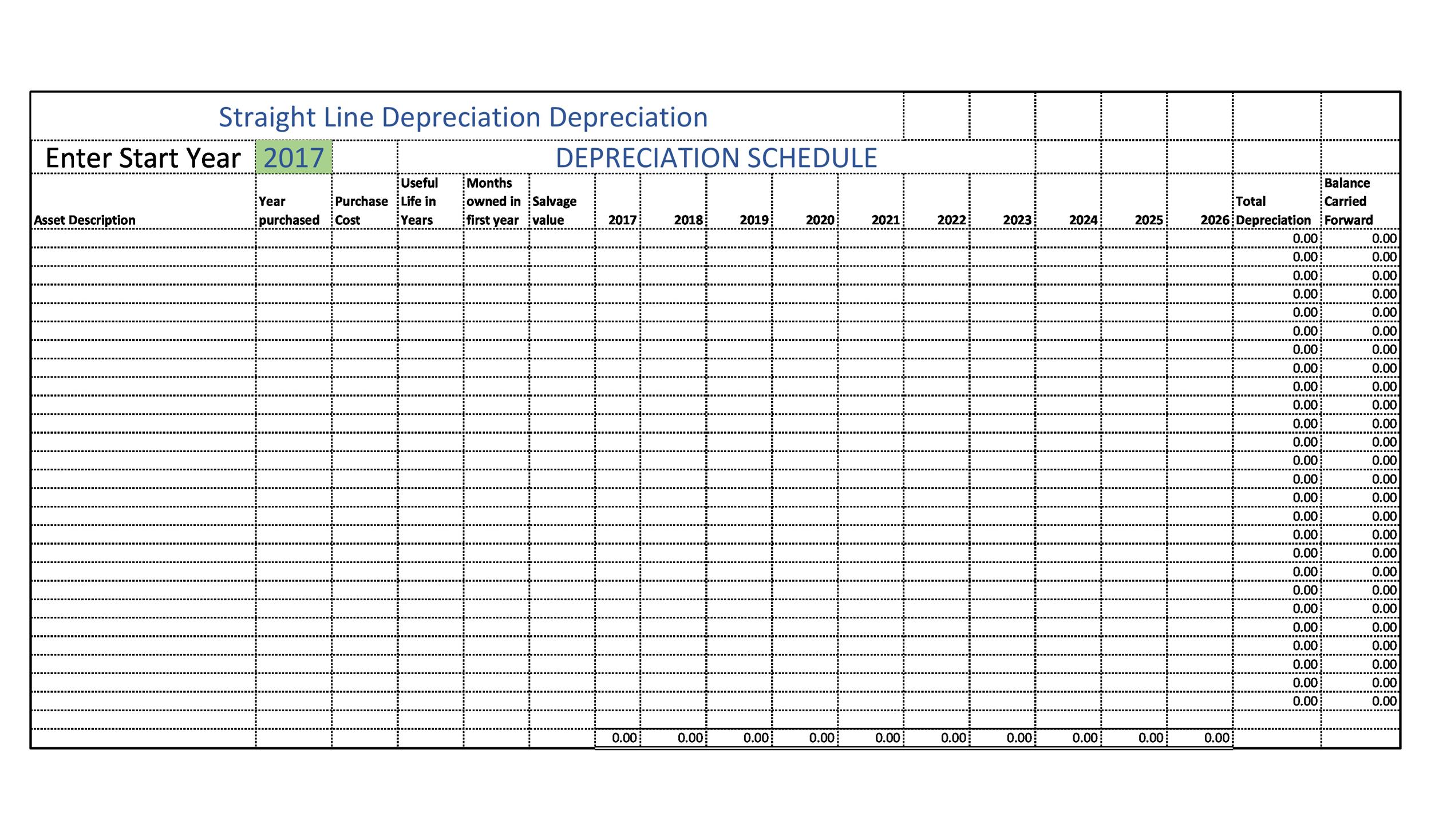

Learn how to create a monthly depreciation schedule in excel with easy methods and formulas. Double declining balance depreciation template. Both depreciation and amortization are ways of.

Amortization & depreciation schedule templates start the discussion! By jeff rohde, posted in investment strategy. Download depreciation calculator template in excel.

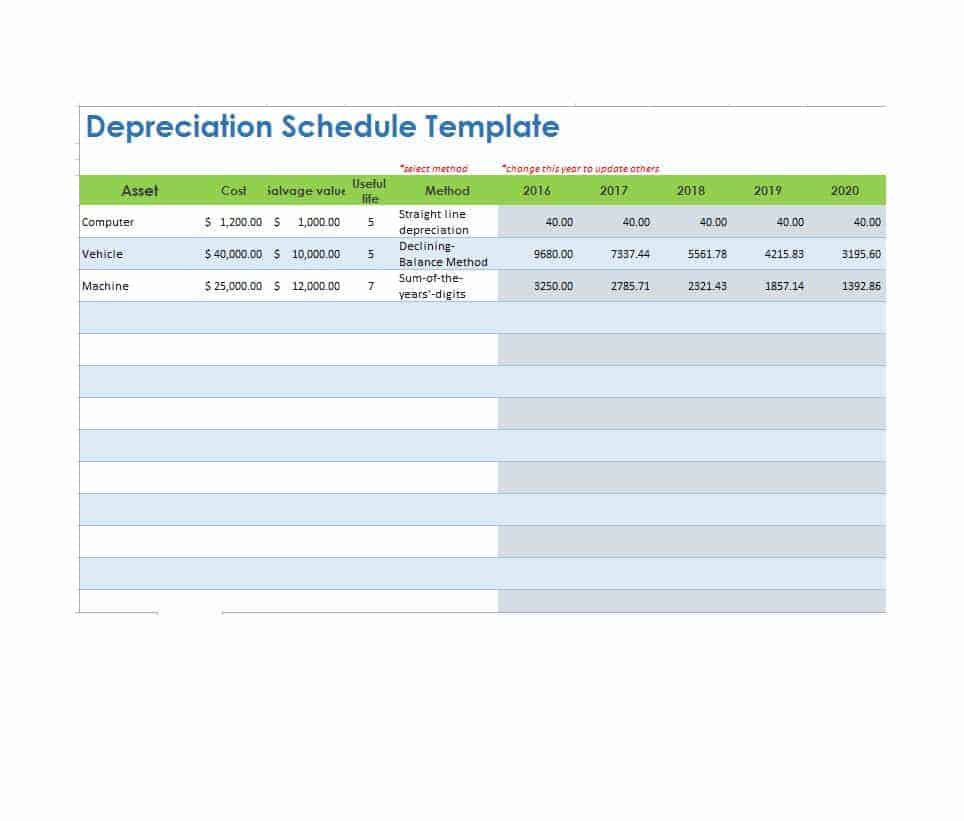

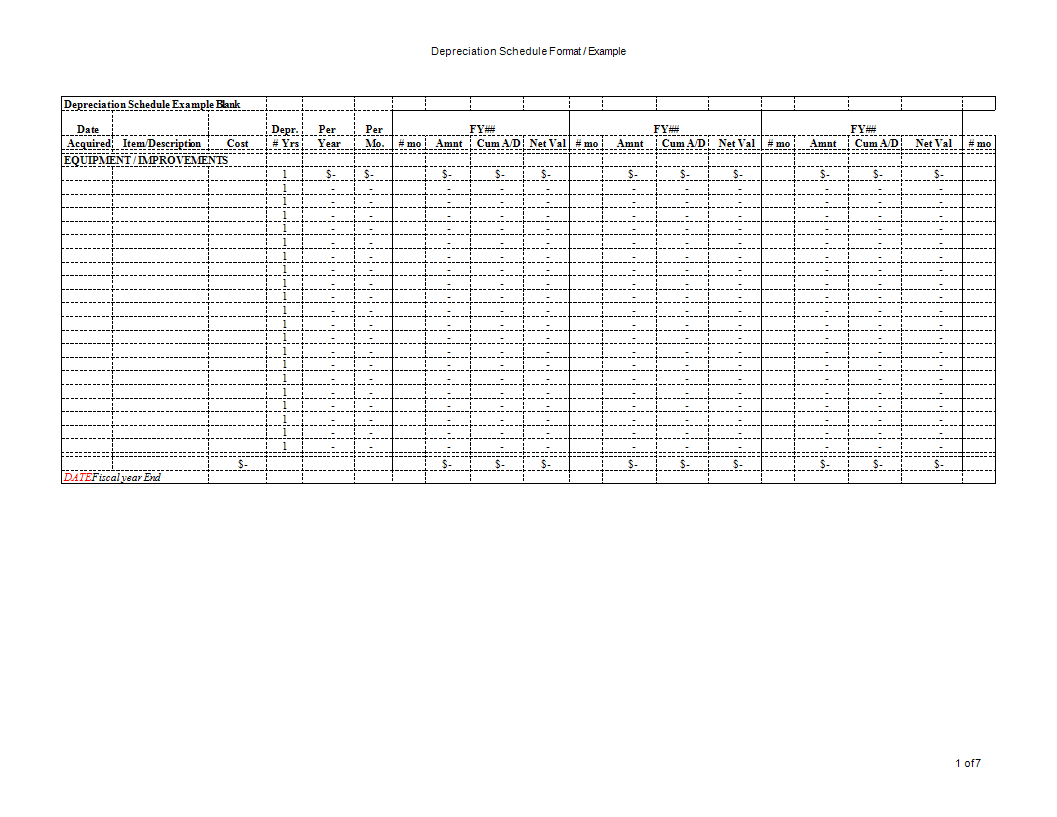

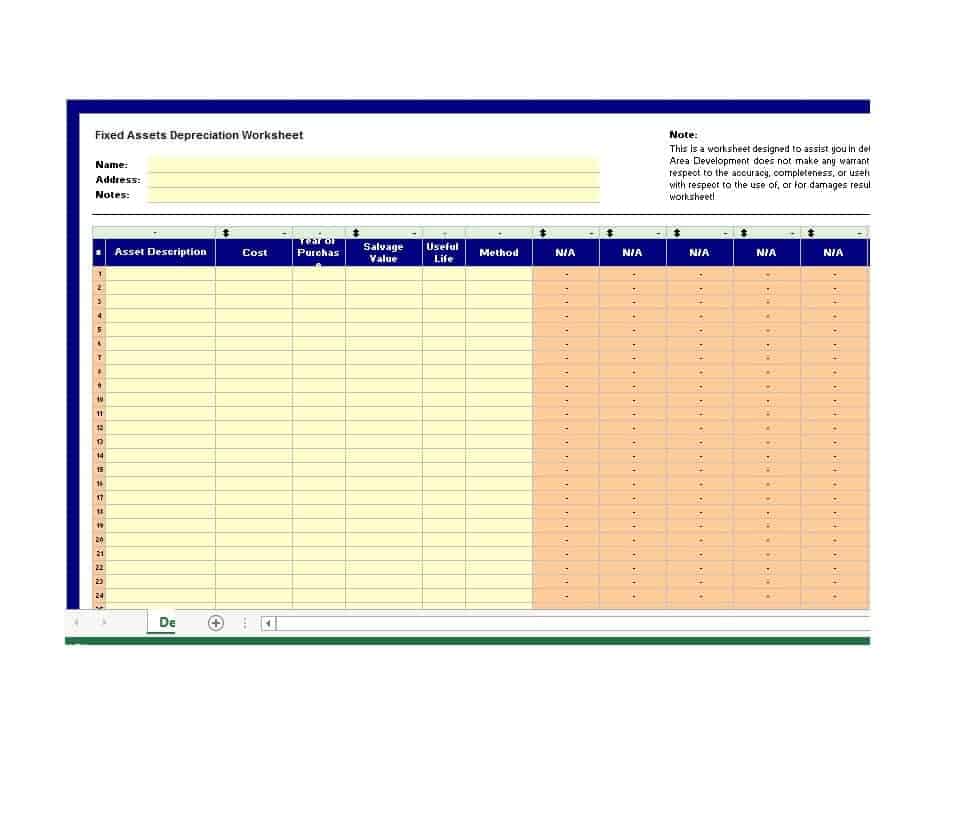

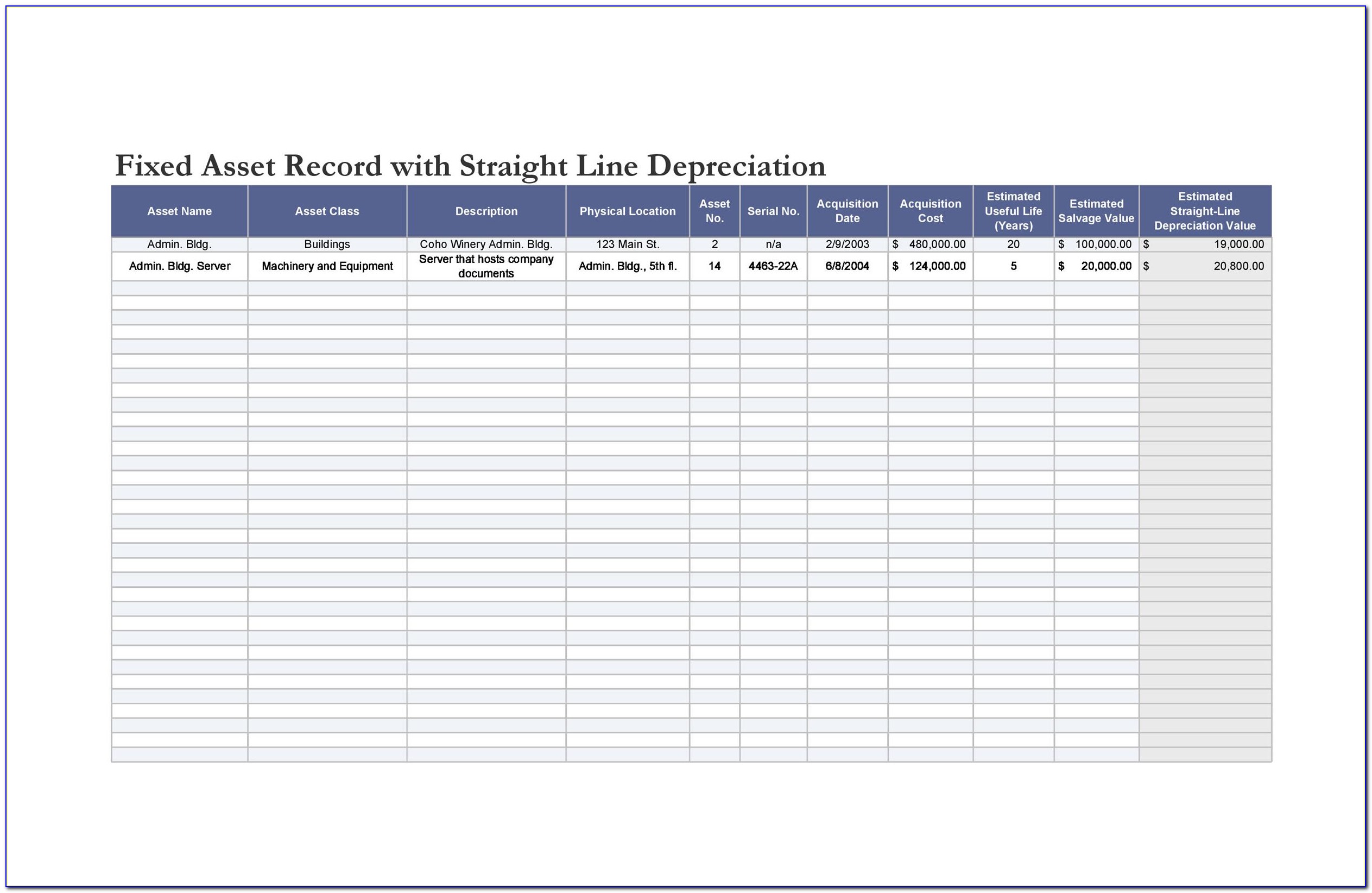

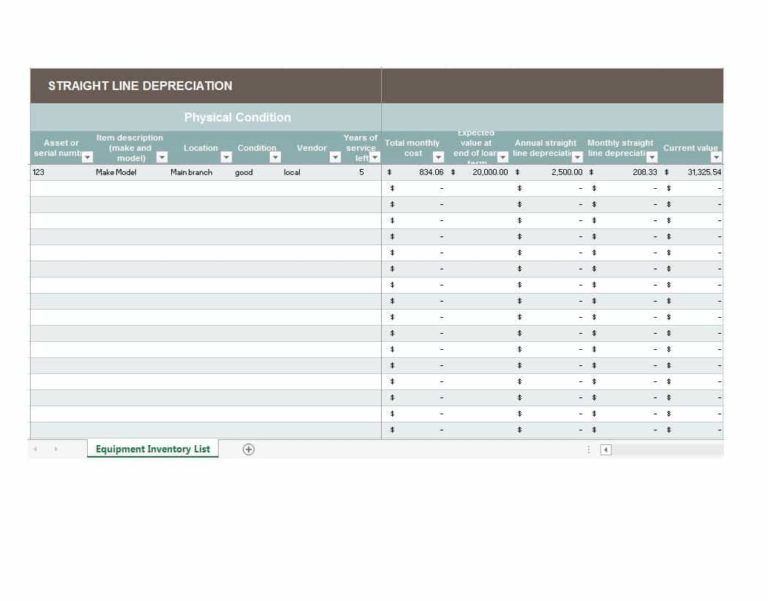

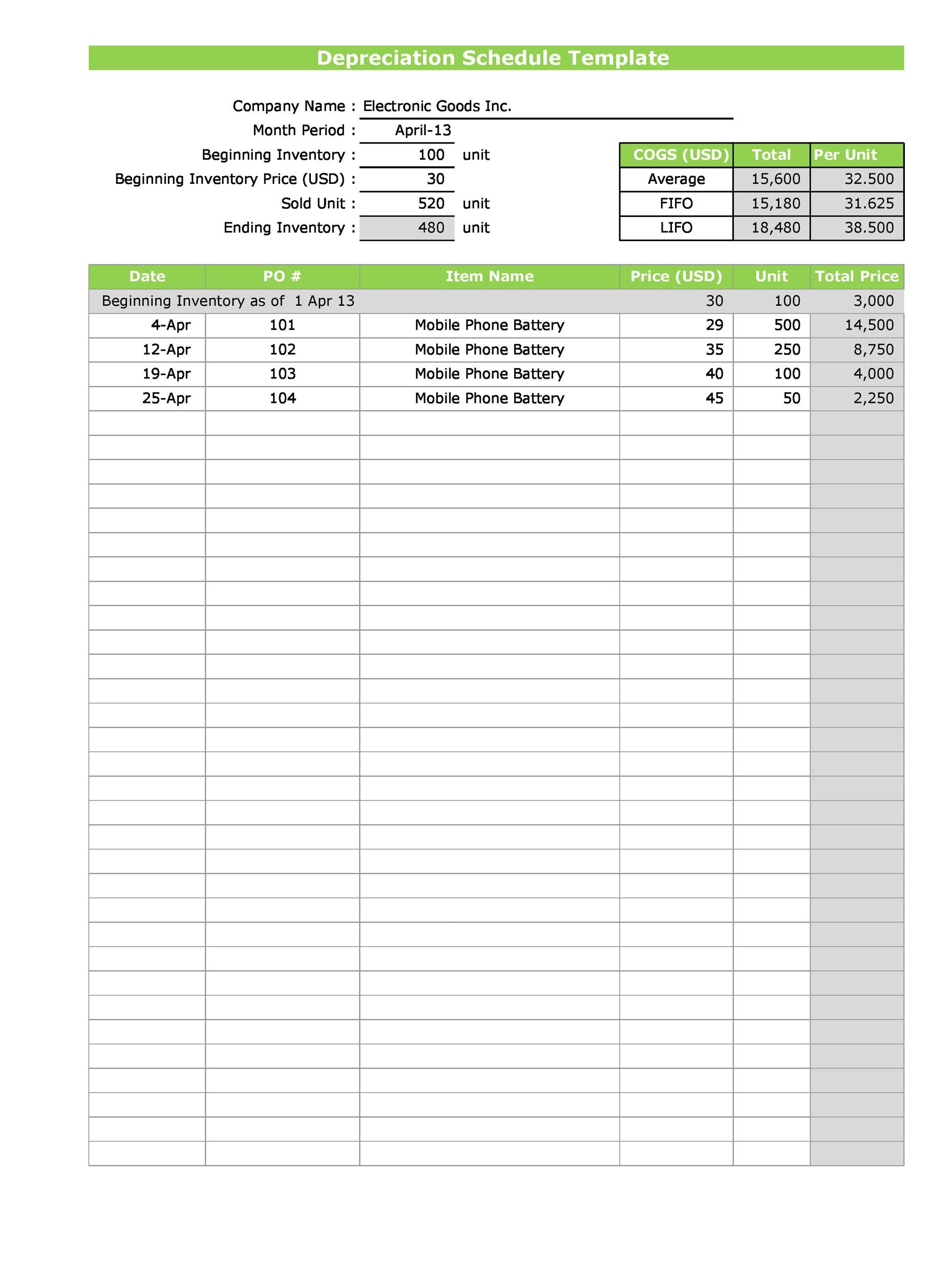

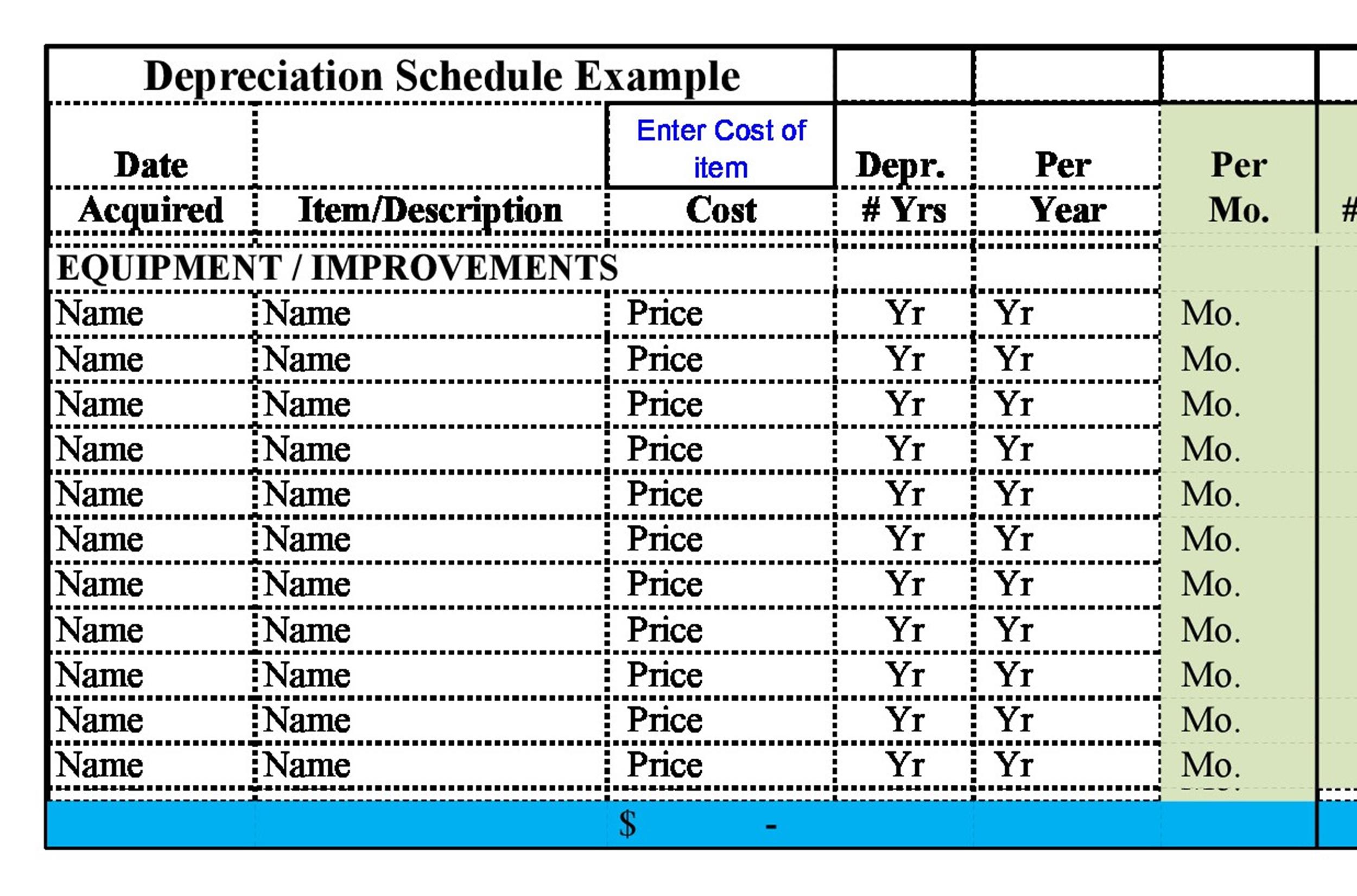

Thank you so much for visiting. The initial cost of the asset; This depreciation schedule template provides a simple method for calculating total yearly devaluation for plural inventory.

Download 28+ simple depreciation schedule templates for various types of assets and methods. This double declining balance depreciation template will help you find depreciation. With this depreciation schedule template, businesses are able to create.

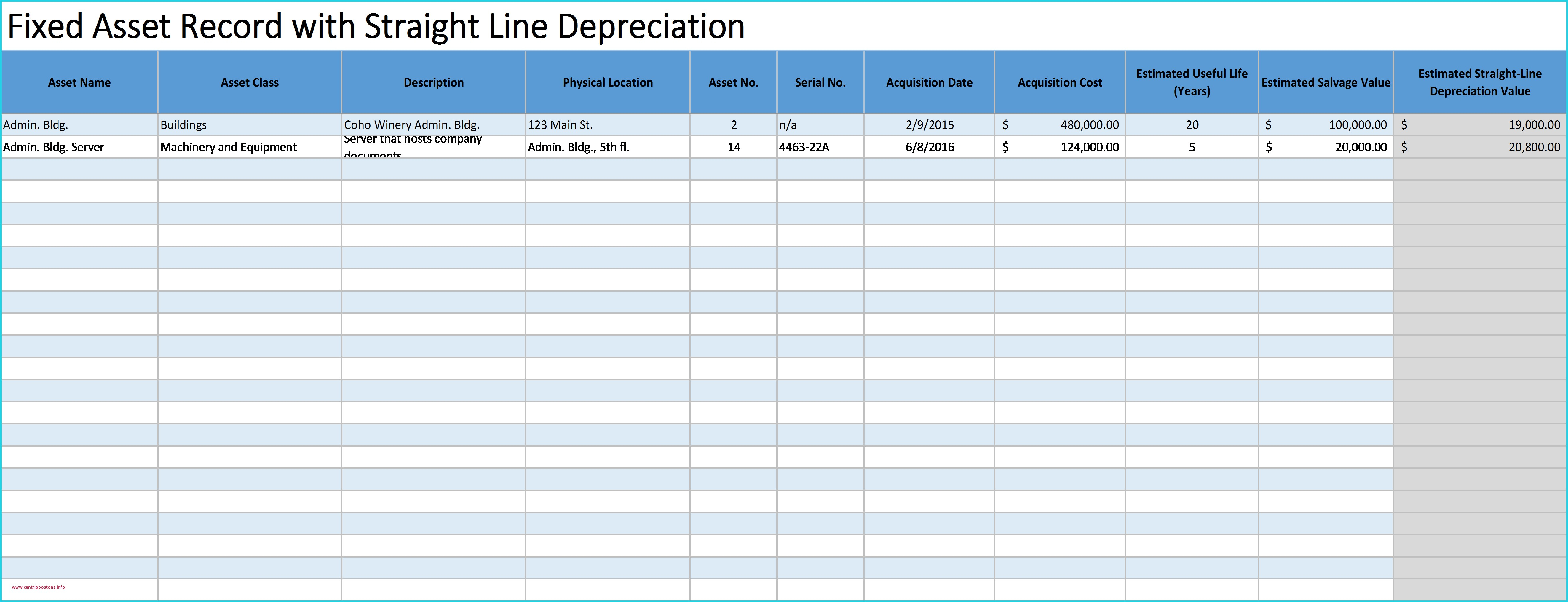

A free rental property depreciation spreadsheet template. Data analysis, excel templates, financial statement. 25+ depreciation schedule template excel free to use.

The depreciation schedule template is free to download, easy to use and completely customizable. Written by cfi team. Learn eight ways to use excel functions to calculate depreciation for different methods and scenarios.

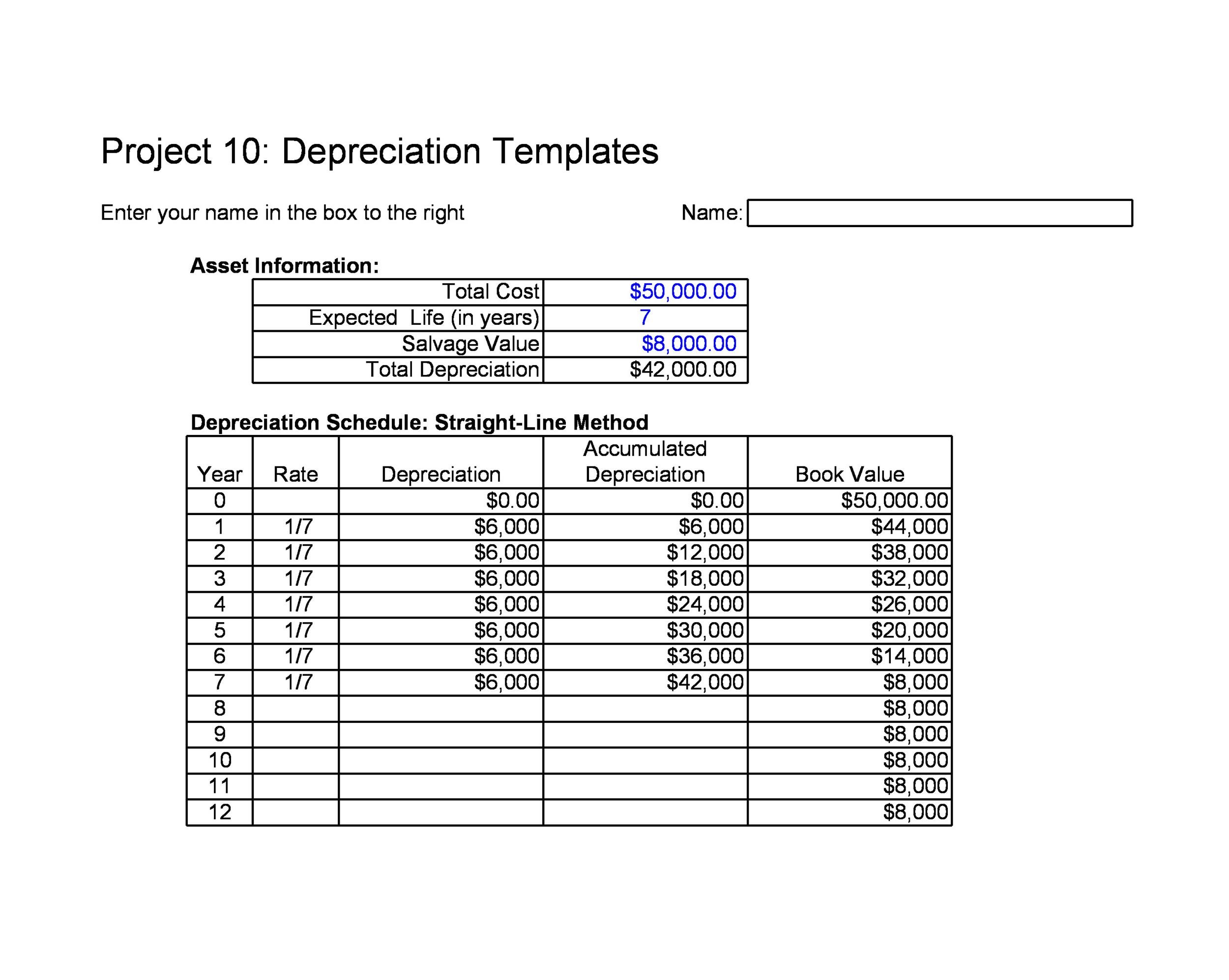

See examples, formulas, and a video tutorial for each. This depreciation methods template will show you the calculation of depreciation expenses using four. The salvage cost at the end of its useful.

Depreciation is a term used to describe the reduction in the value of. My aim is to make you awesome in excel & power bi. Over time, an asset wouldn’t have the same value anymore like when it was.

Learn how to create a depreciation schedule in excel to forecast the value of fixed assets, depreciation expense, and capital expenditures. Each year, accountants reference the table to find. To calculate the annual depreciation value you can use the sln function which requires three pieces of data: